Industry News

OSHA Not Prepared to Accept Electronic Submissions

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

For over a year, the Occupational Safety and Health Administration (OSHA) have championed the upcoming electronic submission of injury and illness records (i.e., OSHA 300 logs) through its website. The new requirement was designed to make OSHA records publicly available on the internet in hopes that it would encourage employers to maintain safer working environments. The electronic submissions of the 2016 reports were supposed to be due by July 1, 2017.

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

For over a year, the Occupational Safety and Health Administration (OSHA) have championed the upcoming electronic submission of injury and illness records (i.e., OSHA 300 logs) through its website. The new requirement was designed to make OSHA records publicly available on the internet in hopes that it would encourage employers to maintain safer working environments. The electronic submissions of the 2016 reports were supposed to be due by July 1, 2017.

However, in a mid-May announcement, the government agency’s website declares “OSHA is not accepting electronic submissions of injury and illness logs at this time, and intends to propose extending the July 1, 2017 date by which certain employers are required to submit the information from their completed 2016 Form 300A electronically.”

According to an article on Front Page News, “several business groups, including the Associated Builders & Contractors, Association of General Contractors, and National Association of Home Builders, had challenged the 2016 Occupational Safety and Health Administration regulation in court and lobbied the administration to jettison it on grounds that it could unfairly damage the reputation of some of their members.”

In preparation of the anticipated electronic submission requirement, developers of Rancho Mesa’s Risk Management Center, an online platform designed for risk management, workplace safety and compliance have been ready and waiting for the details of OSHA’s API (application programing interface) in order to build a seamless integration between the two websites. Rancho Mesa will keep its clients up to date on the development of this integration, if and when it becomes operational on the OSHA website.

As for now, Rancho Mesa is urging its clients to continue to track incidents in the Risk Management Center so they may take advantage of its trending tools and reports.

For details regarding who must keep and report OSHA records, visit www.osha.gov/injuryreporting.

Sources:

“Injury Tracking Application: Electronic Submission of Injury and Illness Records to OSHA.” United States Department of Labor. Retrieved from: https://www.osha.gov/injuryreporting/.

“OSHA suspends rule requiring firms report injury, illness data electronically.” Front Page News. Retrieved from: http://www.advisen.com/tools/fpnproc/news_detail3.php?list_id=26&email=kvasquez@ranchomesa.com&tpl=news_detail3.tpl&dp=P&ad_scale=1&rid=283636777&adp=P&hkg=5cY58Bd37J

Cyberattacks Threaten Small Businesses: Help Protect Your Company's Data by Following These Steps

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

With the recent cyberattacks spreading across the globe, Rancho Mesa would like to remind its clients to take the necessary precautions to protect their business’s data.

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

With the recent cyberattacks spreading across the globe, Rancho Mesa would like to remind its clients to take the necessary precautions to protect their business’s data.

We have supplied two documents to help you prevent a cyberattack: "Cybersecurity for Small Businesses” and “Cyber Security Planning Guide.” Each of the documents may also be found in the Risk Management Center’s Library.

For questions about Cyber Liability insurance, contact us at (619) 937-0164.

Taking Your Safety Program to the Next Level: Form a Safety Committee

Author, Daniel Frazee, ARM, CRIS, Executive Vice President, Rancho Mesa Insurance Services, Inc.

Establishing a safety committee within your company will enhance the effectiveness of your safety program by identifying hazards and appropriate controls, implementing specific measures, developing clear safe work practices and communicating clearly through all levels within your organization.

Author, Daniel Frazee, ARM, CRIS, Executive Vice President, Rancho Mesa Insurance Services, Inc.

"The committee must be prepared to promote the #1 goal of any organization…accident prevention."

Establishing a safety committee within your company will enhance the effectiveness of your safety program by identifying hazards and appropriate controls, implementing specific measures, developing clear safe work practices and communicating clearly through all levels within your organization.

As your company looks to build a new committee or perhaps re-build an existing committee, consider the following as some more specific responsibilities that the group can develop:

- Promoting the importance of accident prevention

- Setting attainable goals for safe work practice

- Building a safety program that is a constant work in progress with regular updates and performance evaluation among departments

- Learning root causes through accident investigation

The committee must be prepared to promote the #1 goal of any organization…accident prevention. Employers want their employees to go home every evening to their loved ones. That goal has to permeate through all ranks and be maintained as the culture from the top down. With that as a primary goal, reasonable expectations have to be set for safe work practices that allow the company to maintain their level of productivity. Best Practices dictates that the safety committee must be willing to constructively critique themselves, the safety program and each department with an objective eye toward constant improvement. Establishing root causes for both “near misses” and accidents without prematurely assigning responsibility to a specific person, can build a more open approach to tracing claim frequency and severity trends. This is the critical piece to learning from mistakes or actions to ensure similar events do not recur.

Some final points to consider for a more effective safety committee:

- Participants should encompass all divisions, departments, and levels within an organization. A minimum of one representative/member from each part of the company should sit on the committee.

- Consider having more employees than supervisors which will build a more ground up approach from those people who know the day to day operations and tasks the best.

- Rotate the safety committee chairperson on a regular interval, whether that be every year or every other year. This will allow opportunity for more people to have a voice and continually change the committee in a positive way.

- Identify a clear schedule and recurring time/day for meetings throughout the year. The chairperson should provide an Agenda in advance of meetings so members can prepare accordingly. That chairperson should also recap each meeting with notes, review of recommendations, previous incidents, and/or trainings that have occurred.

- Include a representative from your insurance company’s loss prevention department to help provide perspective, resources and analysis.

Accept the challenge of taking your Safety Program to the next level, reduce your exposure to claims and improve both your risk profile and bottom line.

Learn more by sending follow up questions to dfrazee@ranchomesa.com.

Additional Resource

“Safety Committee Development: Consider the time required, the budget, needed, and the desired outcomes, and then facilitate the committee’s efforts using these triple constraints as boundaries,” by Michael E. Bingham, Occupational Health & Safety, www.ohsonline.com.

NALP Launches New Discounted Workers' Compensation Insurance Program

The National Association of Landscape Professionals (NALP) is partnering with Rancho Mesa Insurance Services and Berkshire Hathaway Homestate Companies to offer NALP members a competitive workers’ compensation option backed by specialized landscape industry expertise and a dedicated service team.

Article originally published in "The Landscape Professional" March/April 2017 issue.

The National Association of Landscape Professionals (NALP) is partnering with Rancho Mesa Insurance Services and Berkshire Hathaway Homestate Companies to offer NALP members a competitive workers’ compensation option backed by specialized landscape industry expertise and a dedicated service team.

NALP created this program as a member benfit aimed at providing landscape-specific expertise at a discounted rate. A portion of the combined premium is re-invested

back into the association to help fund industry growth and the many programs that benefit NALP members.

The program includes:

- Multiple workers’ compensation options with guaranteed cost and small to large deductibles.

- 6 percent discounted rates for NALP members where allowable. Lowest available base rate in states that do not allow rate deviation.

- Flexible payment plans including stipulated, pay as you go (zero deposit) and monthly payroll reports.

- Quarterly safety webinars specific to the injuries arising out of the landscape industry.

- Dedicated service team with landscape industry specific experience in the workers’ compensation claims, injuries and exposures.

- Underwriting team evaluating only NALP members.

- Claims handling dedicated to NALP members with lower caseloads and the statistically proven ability to close claims faster than the industry.

- Loss control with regional representation for on-site visits managed nationally by a dedicated coordinator.

“Protecting your business, your employees and your bottom line is so important, so we are pleased to bring this highly competitive and tailored workers’ compensation insurance program to landscape and lawn care companies through this new partnership with Rancho Mesa and Berkshire Hathaway,” NALP CEO Sabeena Hickman, CAE, said.

The program is managed by Rancho Mesa Insurance Services, which has 10 consecutive years as a National Best Practices Agency, and policies are underwritten by Berkshire Hathaway, an A++XV rated financial services firm.

For more information, visit bit.ly/nalpworkerscomp. If you have further questions or want to sign up, email nalp@ranchomesa.com or call program manager Drew Garcia at 619-937-0200.

Reproduced with permission from the National Association of Landscape Professionals.

Is Your Business Protected from Data Breach Costs and HIPAA Violations?

Author Chase Hixson, AAI, Human Services Group, Rancho Mesa Insurance Services, Inc.

As technology and the common usage of the internet in business grow, Cyber Crime is an ever increasing exposure for businesses. Most businesses carry large quantities of sensitive data that if breached, can create a financial and administrative headache. Many business owners are unaware of the real exposures they have should their information be compromised, whether directly or indirectly.

As technology and the common usage of the internet in business grow, Cyber Crime is an ever increasing exposure for businesses. Most businesses carry large quantities of sensitive data that if breached, can create a financial and administrative headache. Many business owners are unaware of the real exposures they have should their information be compromised, whether directly or indirectly. Here are two of the most common costs:

Required Notifications under HIPAA

Businesses are required to notify affected individuals following the discovery of a breach. If more than 500 individuals are affected in a given state or jurisdictions, they are required to notify the media as well. A 2015 article from the HIPAA Journal estimated the average cost per record is $154. That means if you had a known breach resulting in 100 clients’ information being breached (regardless of what they do with the information) you would be paying roughly $15,000 just to notify the public. This does not include the added IT costs needed to further investigate/mitigate any losses.

Violations Under HIPAA

Violations vary depending on the degree to which a business is found negligent. The mildest violation is a Category 1, while the most severe is a Category 4. In the case of a Category 1 violation, a business will be penalized $100 per violation, even if they were unaware and reasonably could not have avoided a breach. Category 4 violations can be up to $50,000 per violation.

This is an ever growing exposure that is often overlooked until it happens and then the realization of what’s required hits home. However, there is a way for companies of all sizes to protect themselves from these exposures by including Cyber Liability coverage as a part of their risk management program. This coverage is available and will step in and pay some of the costs associated with a breach. These costs include HIPAA fines, notification costs, credit protection costs and forensic investigation.

This is such a growing area of concern that we have scheduled a “Cyber Liability” workshop for May 10th where an expert on this topic from Philadelphia Insurance Company will lead the workshop and provide both an overview of the trends and threats as well as answering specific questions. If you or someone from your company is interested in attending this workshop, you can register for it below.

Contact our Rancho Mesa staff to learn more about Cyber Liability.

What is SB 562 all about?

It may be of interest, if not importance, for all Californians to know about current proposed legislation, sponsored by Senator Ricardo Lara of Bell Gardens and Senator Toni Atkins of San Diego. The proposed bill would significantly expand the role of the state government within the healthcare system, by essentially establishing a single-payer system.

It may be of interest, if not importance, for all Californians to know about current proposed legislation, sponsored by Senator Ricardo Lara of Bell Gardens and Senator Toni Atkins of San Diego. The proposed bill would significantly expand the role of the state government within the healthcare system, by essentially establishing a single-payer system.

Under Senate Bill 562 (SB 562), the State would cover all medical services for every resident regardless of income or immigration status, including inpatient, outpatient, emergency, dental, vision, mental health, and nursing home care. Furthermore, insurers would be prohibited from offering benefits that cover the same services, potentially resulting in their choice to exit the marketplace. While the proposed bill touts that the program would eliminate co-pays and deductibles, and the need to obtain referrals, there is no mention of how it would be funded, except through “broad-based revenue.”

Obviously, many people ask me about the direction healthcare is headed in California and the Country; to which, I do my best to eliminate my interest in the subject since I make my living guiding companies through the insurance process. But, I do offer up some food-for- thought in terms of evaluating such a proposal, including citing the increasing shortfall of funding for Medicare, and the VA as examples of government-run healthcare, as it seems to me the former is going to require an eventual increase in payroll taxes, which effects everyone, employers and employees alike, and the latter is a good example of inefficiency and lack of innovation when there is no competition.

Personally, I believe that healthcare is both a right and a responsibility. As out-of-whack as the current system seems, or let’s face it, is, I just don’t know how we go about funding such a proposal without breaking the proverbial bank. The financial and economic realities have to be weighed with the politics, which is why it’s a bit of a relief that Governor Jerry Brown has asked the question in return, “Where do you get the extra money? This is the whole question?”

Whatever my thoughts, it is certainly a complex and vexing economic, social, and political issue for our times, one that will continue to be hotly debated and legislated, so there is much more to come.

Commercial Auto Premiums Are Rising - What’s Driving the Increases?

Author David J. Garcia, C.R.I.S., A.A.I., President Rancho Mesa Insurance Services, Inc.

The insurance industry is experiencing record losses on their commercial auto books of business, which is dramatically driving up insurance premiums for business owners. There are many factors that are contributing to this increase in losses; let’s take a look at six of the most prevalent.

Author David J. Garcia, C.R.I.S., A.A.I., President Rancho Mesa Insurance Services, Inc.

The insurance industry is experiencing record losses on their commercial auto books of business, which is dramatically driving up insurance premiums for business owners. There are many factors that are contributing to this increase in losses; let’s take a look at six of the most prevalent.

1. Distracted Drivers. This one factor is now contributing over 30% of all accidents reported. This is the single most significant issue facing not only the commercial insurance marketplace, but personal auto usage as well. Whether it’s talking on the phone, viewing and answering emails, or texting, these trends are escalating at alarming rates.

2. Higher Auto Repair Costs. This is one of the hidden “new” claim costs that insurance companies are facing. Record auto sales of newer vehicles that include sensors, cameras and other new electronics are bringing the cost of repairs to higher levels than ever before. As an example, minor fender repairs might have been a few hundred dollars in the past, but now with sensors and cameras built into most new vehicle bumpers, this cost has risen into the thousands of dollars.

3. Increase in Miles Driven. Since recovering from the recession, a healthier economy has lead businesses to expand and hire more employees. Now, with an increased need for more company-owned vehicles, more miles are driven which leads directly to an increase in accidents.

4. Rising Medical Costs. The medical costs associated with treating auto accident victims is rising 1.5 times faster than any other cost associated with auto incidents. While this probably comes as no surprise given the state of our health care costs, in general, it plays a major role in driving up commercial auto losses, and thus, premiums.

5. Fatalities and Severe Accidents Increasing. With an increase in miles being driven and the distracted driving epidemic, the severity of accidents has grown proportionately.

6. Less “Skilled Driver” Availability. The growth in business and the need for more drivers has resulted in a shortage of skilled commercial drivers. The lack of availability has also increased the likelihood for more auto accidents to occur.

As a business owner, what can you do to minimize this exposure and help control your present and future auto premiums? The process starts with having a formal written “Vehicle Safety Program” in place that is specific to your company’s needs and exposures. The following will outline major areas that the Vehicle Safety Program should address.

- Management Commitment – strong management involvement and concern must be evident

- Vehicle Operator Responsibilities – distracted driving guidelines and consequences, a description on how the vehicle may and may not be used, etc.

- Driver Selection - established criteria in order to be eligible to drive, should include age, MVR history, etc.

- Accident Investigation – formal written process for documenting, reporting and the resulting training to prevent similar accidents

- Vehicle Maintenance – establish a process for regular and consistent care of the vehicles tires, brakes, oil, etc.

In addition to the above, there are other areas that need to be addressed in more detail in order for you to build your own comprehensive Fleet Safety Program. In order to get started, you may want to reach out to your existing auto insurance carrier, as many carriers will offer assistance to their policyholders for creating a safety program.

Furthermore, Rancho Mesa has a proprietary template for our clients, as they design new and re-design existing Fleet Safety Programs. We also offer Fleet Safety Training workshops twice a year to assist in this process. Our workshops are free of charge and offered to current and prospective clients.

Should Union Janitorial Employers have a lower Workers’ Compensation rate than Non-Union Employers?

Author Jeremy Hoolihan, CRIS, Janitorial Group Leader Rancho Mesa Insurance Services, Inc.

A recent study by the Commission on Health, Safety and Workers’ Compensation made an argument that the janitorial industry should be split into two workers’ compensation class codes. This change would be similar to how many construction operations field class codes are separated between an over and under dollar amount per hourly wage. As an example, an electrical contractor’s field wages are split at over and under $30/hour.

Author Jeremy Hoolihan, CRIS, Janitorial Group Leader Rancho Mesa Insurance Services, Inc.

A recent study by the Commission on Health, Safety and Workers’ Compensation made an argument that the janitorial industry should be split into two workers’ compensation class codes. This change would be similar to how many construction operations field class codes are separated between an over and under dollar amount per hourly wage. As an example, an electrical contractor’s field wages are split at over and under $30/hour. Why does this matter? It matters, because the workers’ compensation marketplace perceives the higher-wage-earner to be a safer risk (the thinking being - a higher-wage-earner is more experienced and less likely to sustain injury), thus, the workers' compensation premium rates are less for those in the “above” threshold category. However, the BIG difference between this rationale and the study is that rather than basing the split rates on pay scale, the study proposes the split be between Union and Non-Union companies.

The study’s line of reasoning is that Union firms have fewer injuries and as a whole have a much lower loss ratio than Non-Union firms. However, many industry experts disagree and believe that the figures are skewed and not representative of the true industry experience. Clearly with the varying opinions and so much at stake, much more research and discussion needs to take place before anything is implemented.

With that said, in order to remain relevant and competitive, all janitorial companies need to stay well informed and be prepared for any changes should they occur. Rancho Mesa’s janitorial department will keep a close eye on any new developments and continue to help improve your company's risk profile, so you will be well informed and prepared for any changes. If you have any questions please feel free to contact us

Adding an Additional Obligee to a Performance Bond

Author Matt Gaynor, Director of Surety at Rancho Mesa Insurance Services, Inc.

A Rancho Mesa construction client recently asked if they should be concerned when asked to add a Duel Obligee to a Performance Bond on a construction contract. The short answer is “no.” But, let’s expand on that answer.

Author Matt Gaynor, Director of Surety at Rancho Mesa Insurance Services, Inc.

A Rancho Mesa construction client recently asked if they should be concerned when asked to add a Duel Obligee to a Performance Bond on a construction contract. The short answer is “no.” But, let’s expand on that answer.

It has become increasingly more common for project lenders to require they be added as an additional named obligee/beneficiary under construction performance bonds. Since the lender will be providing the financing for the construction project, they ultimately want to ensure the work is completed in a timely and satisfactory manner.

The request is usually solved by attaching a Dual Obligee Rider to the Performance Bond. The rider provides the lender with the same rights as the original obligee, as long as they agree to assume the owner’s obligations to the bonded contractor under the contract.

Rancho Mesa recommends its clients ensure the lender sign the Dual Obligee Rider as acceptance of the terms of the rider. By having both parties (the original obligee and the lender) sign the rider when the Performance Bond is issued, the contractor gains assurance that the lender will meet the same obligations as the owner in the event of a claim under the Performance Bond.

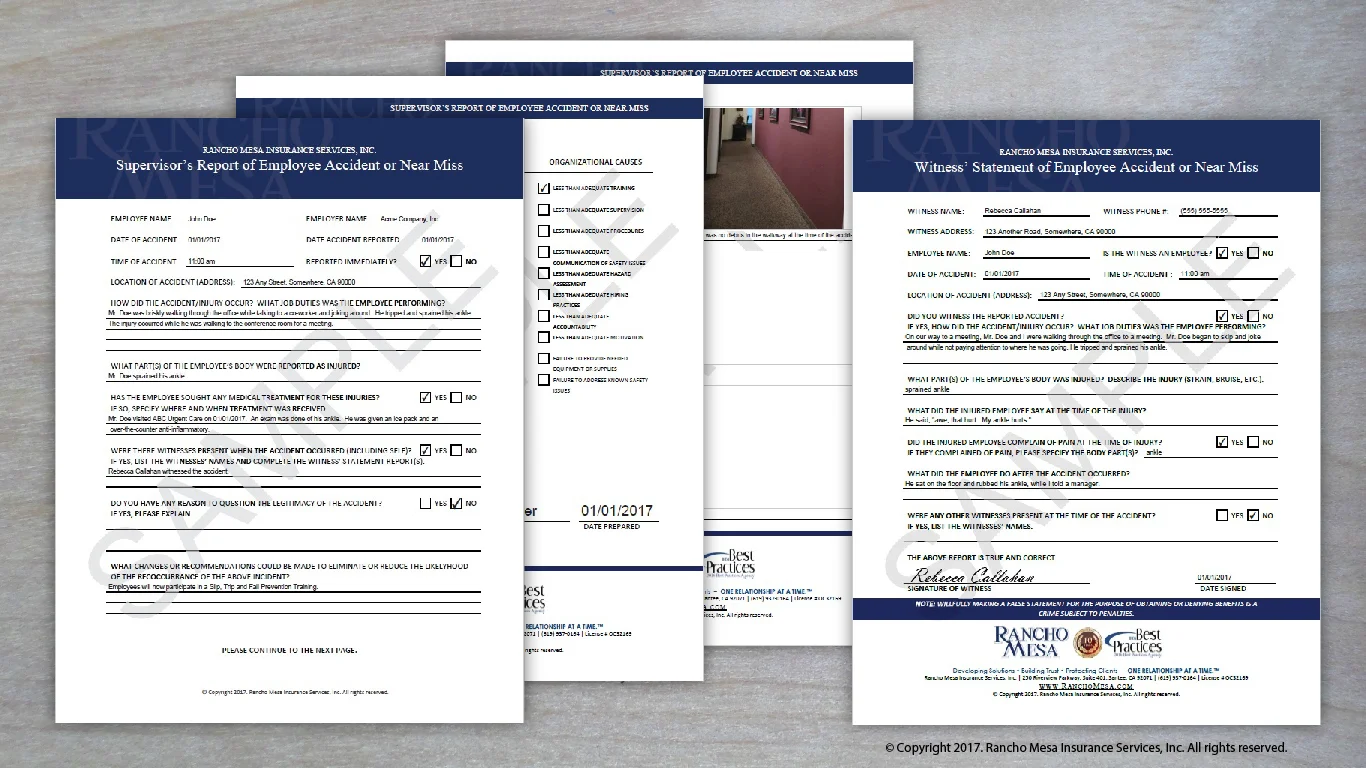

Help Control Your Workers’ Compensation Claim Costs through Accident Investigation

Authors, Dave Garcia, AAI, CRIS, President and CEO, and Drew Garcia, NALP Program Director from Rancho Mesa Insurance Services, Inc.

When a workers’ compensation claims occurs, in order to both control the costs of the claim and look for preventive measures to reduce or eliminate similar claims from reoccurring, it is vital that a thorough accident investigation report is completed.

Authors, Dave Garcia, AAI, CRIS, President and CEO, and Drew Garcia, NALP Program Director from Rancho Mesa Insurance Services, Inc.

When a workers’ compensation claims occurs, in order to both control the costs of the claim and look for preventive measures to reduce or eliminate similar claims from reoccurring, it is vital that a thorough accident investigation report is completed. The accident investigation report should be completed at the time of the accident, by the supervisor overseeing the injured employee, and contain the following information:

- Employee name, date, time and location of the accident,

- A description of how the injury occurred and the job duties the employee was performing when they were injured,

- The employee’s body part(s) that were reported as injured,

- If witnesses were present when the accident occurred, document their names and statements using the Witness’ Statement of Employee Accident or Near Miss Report,

- Pictures of the injury and accident area,

- Recommendations or changes that could be made to eliminate or reduce the potential for a similar claim in the future.

The goals of this process are:

- To have a timely and accurate record of the accident or incident that allows the claim to be reported to the insurance carrier in a timely manner.

- To help you to reduce the chance of fraudulent claims through documentation, pictures and witness statements.

- To analyze the root cause of the accident or near miss and implement the needed recommendations to reduce or eliminate the likelihood of future claims.

As a 10-time National Best Practices Agency, Rancho Mesa Insurance Services, Inc. understands the importance of implementing the highest standards of Risk Management practices for our clients. So, as part of our RM365 Advantage™ program, we have developed our own proprietary Employee Accident Report and Witness Statement to assist our clients with documentation of their accidents or near misses.

Closing the "Gaps in Coverage" When Using Temporary or Leased Labor

Author, Dave Garcia, AAI, CRIS, is the President and CEO of Rancho Mesa Insurance Services, Inc.

It has become more common for construction companies to use temporary or leased labor in order to meet the demands of their work. While this is a useful tool it can create some unintended gaps in coverage for the contractor hiring the temporary or leased labor. These gaps potentially exist for on-the-job injury claims suffered by the temporary or leased workers.

Author, Dave Garcia, AAI, CRIS, is the President and CEO of Rancho Mesa Insurance Services, Inc.

It has become more common for construction companies to use temporary or leased labor in order to meet the demands of their work. While this is a useful tool, it can create some unintended gaps in coverage for the contractor hiring the temporary or leased labor. These gaps potentially exist for on-the-job injury claims suffered by the temporary or leased workers.

The question for all construction companies is: if you use workers from staffing or leasing agencies to supplement your workforce, how adequately do your current insurance policies protect your company in the event that one of these individuals is injured on the job?

Following are two recommendations in order to better protect your interest and help close those gaps.

Alternate Employer Endorsement

(WC00 03 01 A)

It is recommended that an endorsement is added to a workers' compensation policy that provides an entity scheduled as an alternate employer, with primary workers compensation and employers liability coverage, as if it were an insured under the policy. This endorsement is commonly used when a temporary help agency (the insured) is required by its customer (the alternate employer) to protect the alternate employer from claims brought by the insured's employees.

Businesses may find themselves short staffed on occasion, and will seek out the services of a temporary staffing or leasing agency to fill the gaps. Workers that are employed through the temporary staffing or leasing agency are covered under the workers' compensation policy that the temporary staffing or leasing agency has purchased. When these workers are hired out to an outside firm, the firm that hires them should seek an “alternate employer endorsement” from the temporary staffing or leasing agency, in order to protect it from any lawsuits brought by the temporary employee for injuries they may suffer.

For example, a construction company needs some additional labor in order to complete a job on time. It hires some temporary labor. If a temporary employee injures themselves or has to go to an emergency room, they would be covered under the temporary staffing or leasing agency’s workers' compensation policy, thus, prohibiting them from making a claim against the construction company’s liability policy.

When an alternate employer endorsement is added to a policy’s endorsement schedule, the employer (contractor in this example) is often required to assist in any claims investigations. This scenario typically means reporting any injuries suffered by temporary or leased staff, ensure that the temporary employee is given proper medical treatment when the injury is suffered; and provide any documentation related to the injury to the policyholder (temporary staffing or leasing agency). If the policy is canceled for any reason, the insurance company is not obligated to tell the alternate employer (contractor) because the alternate policyholder (contractor) is not the primary party on the policy.

Coverage for Injury to Leased Workers Endorsement

(CG 04 24)

A second way to help close this potential gap is by adding the above endorsement to your (the contractors) existing general liability policy. However before filling this gap it is first important to understand how the gap is created. A gap in coverage arises from the way the CGL policy defines "temporary" and "leased" workers. Following are those definitions.

“Leased Worker” is a person leased to you by a labor leasing firm under an agreement between you and the labor leasing firm, to perform duties related to the conduct of your business. "Leased worker" does not include "temporary worker."

"Temporary worker" means a person who is furnished to you to substitute for a permanent "employee" on leave or to meet seasonal or short-term workload conditions.

Under the terms of a CGL policy, "employee" includes a leased worker, but does not include a temporary worker. The distinction is important, because the CGL policy's Exclusion e: employers liability, excludes from coverage bodily injury claims made by an employee of the insured. Thus, if your CGL policy definitions consider the worker to be an "employee"- even though that worker is provided by a staffing agency - the policy will not cover any bodily injury claims by that worker.

If the worker is not specifically substituting for a permanent employee who is on leave, or meeting a seasonal need or short-term workload conditions, the worker is not a "temporary worker" in the eyes of the insurer, and instead is considered your employee for purposes of Exclusion e.

To be a "temporary worker," that individual must have a specific end date to his or her employment with you. A temporary employee who is hired for an indefinite period of time simply does not meet the criteria stated above, and is therefore considered an employee, and subject to Exclusion e if they are injured on the job.

Adding the Coverage for Injury to Leased Workers (CG 04 24) endorsement to your CGL policy will help you fill this coverage gap. This endorsement states that the term "employee" does not include a "leased worker" or "temporary worker," making the employers liability exclusion of the CGL policy inapplicable to the claims for injuries to a leased or temporary worker.

Without the right coverage in place, on-the-job injuries to temporary workers can present a significant potential liability to your company. Examine your current CGL policy and arrangements with any staffing or leasing firms you use to make sure your company is adequately protected.

How to Prevent Back Injuries in the Landscape Industry

Author, Drew Garcia, with Rancho Mesa Insurance Services, is the program director for NALP’s Worker’s Compensation Program.

According to the Workers Compensation Insurance Rating Bureau (WCIRB), in the last 5 years, over a quarter of a billion dollars in back injury claims, on behalf of the landscape industry, have been paid out by carriers in California. The back claim is by far the most costly injury at $22,000 over the last five years and the second highest in terms of frequency (behind hand, wrist and finger injuries), and the leading claim resulting in an employee's time away from work.

Author, Drew Garcia, with Rancho Mesa Insurance Services, is the program director for NALP’s Worker’s Compensation Program.

According to the Workers Compensation Insurance Rating Bureau (WCIRB), in the last 5 years, over a quarter of a billion dollars in back injury claims, on behalf of the landscape industry, have been paid out by carriers in California. The back claim is by far the most costly injury at $22,000 over the last five years and the second highest in terms of frequency (behind hand, wrist and finger injuries), and the leading claim resulting in an employee's time away from work.

Consider

- Back claims are most costly.

- They are the second most frequent claim reported.

- They are the leading claim resulting in an employee losing time away from work.

Reflect

- Has your company had a back injury in the past?

- What are you doing to protect the backs of your employees?

- Would it be worth your time to consider ways to mitigate this exposure?

Solution

Implementing a pre-work stretch, when done properly, is a quick and effective solution to reduce the likelihood of back injuries. The following stretch program was designed to stretch the back with Professional Landscapers in mind. The program can be executed in minimal time, at any location (yard or on-site) and will not only help employees warm up for the day, but also strengthen their back to help maintain a healthy career.

Benefits

By implementing a stretch you are:

- Showing your employees that you care about their health and have explored an option to help keep them safe.

- Differentiating your companies risk profile against the industry to help enforce aggressive underwriting.

- Looking for a way to improve employee productivity while potentially decreasing insurance cost directly related to claims.

Why are hand injuries the most frequent claim reported in the Landscape Industry?

Author, Drew Garcia, with Rancho Mesa Insurance Services, is the program director for NALP’s Worker’s Compensation Program.

The landscape industry experiences frequent hand, wrist and finger injuries - they're three most frequent types of Workers Compensation claims. Employees complain their personal protection equipment (i.e., gloves) limit dexterity, prohibiting finger movement, causing difficulty in performing their jobs. As a result, employees remove their safety gloves to perform their job-related activities, and experience hand, wrist and finger injuries.

Author, Drew Garcia, with Rancho Mesa Insurance Services, is the program director for NALP’s Worker’s Compensation Program.

The landscape industry experiences frequent hand, wrist and finger injuries - they are the three most frequent types of Workers Compensation claims. Employees complain their personal protection equipment (i.e., gloves) limit dexterity, prohibiting finger movement, causing difficulty in performing their jobs. As a result, employees remove their safety gloves to perform their job-related activities, and experience hand, wrist and finger injuries.

To help reduce the number of hand, wrist and finger injuries, it is important to find a glove that fits comfortably, forms to the hand and allows for maximum dexterity, while providing superior protection.

Rancho Mesa has partnered with StoneBreaker Gloves, a leader in glove manufacturing, to offer a discount of 25% off our clients' orders with a promo code (Contact your broker for the code). StoneBreaker has designed gloves specifically for Professional Landscapers and carries a range of products from the standard dipped glove to a 28 piece crafted leather glove.

While Rancho Mesa has negotiated discounted pricing, it is not making any profit on the sales of StoneBreaker gloves. Rancho Mesa simply feels it is our job to connect the dots in an effort to better protect our clients.

Please visit www.stone-breaker.com to purchase your safety gloves. If you purchase gloves from StoneBreaker, be sure to send us pictures of your employees wearing them, so we can relay your commitment to safety with the carrier!

4 Factors That Shape Your Insurance Risk Profile

Author, Drew Garcia, with Rancho Mesa Insurance Services, is the program director for NALP’s Worker’s Compensation Program.

Ever wonder why your insurance rates high when your competitors are low? There are reasons for that including, frequency of claims, severity of claims, experience rating, average claim cost incurred, operations, trends, loss ratio etc. If you evaluate your risk profile you can take action to lower your premiums.

Author, Drew Garcia, with Rancho Mesa Insurance Services, is the program director for NALP’s Worker’s Compensation Program.

Ever wonder why your insurance rates high when your competitors are low? There are reasons for that including, frequency of claims, severity of claims, experience rating, average claim cost incurred, operations, trends, loss ratio etc. If you evaluate your risk profile you can take action to lower your premiums.

Here are 4 factors that help shape your risk profile.

Frequency of Claim

The number of workers’ compensation claims you average per million dollars in payroll.

Calculation = # of claims / (annual payroll/$1,000,000)

Evaluate – How often are you having workers’ compensation claims and how does that compare to other landscape companies in your region or state? You can expect your insurance premiums to be higher if your frequency rate of claim is higher than the average.

Action – If you are having a frequency issue, you need to assess;

- Trends (back, hand, wrist, knee…)

- Cause (lifting, punctures, slips…)

- Implement corrective actions to help mitigate the risks associated with your claims.

Take it to the next level and evaluate “near misses.” Treat a “near miss” as if it were a claim and strategize a corrective action to prevent it from happening in the future.

Lost Time Claims (Indemnity)

The number of “lost time” claims your company has per million dollars in payroll. These are the claims in which your employee loses time away from work.

Calculation = # of lost time claims / (annual payroll/$1,000,000)

Evaluate – How often are you having workers’ compensation claims that result in lost time and how does that compare to other landscape companies in your region or state? You can expect your insurance premiums to be higher if your Indemnity rate of claim is higher than the average.

Action – If you are having an indemnity issue, you need to assess;

– Trends (back, hand, wrist, knee…)

– Cause (lifting, punctures, slips…)

– Implement corrective actions to help mitigate the risks associated with your claims.

Establish a “return to work program” which allows your injured employees an opportunity to come back to work on limited duty. This will help you monitor your employee’s progress and keep them feeling a part of the team.

Experience Rating

Your experience rating is a combination of your loss data and total payroll when compared to your industry typically but not always, over a three year period. Your experience rating has the ability to credit or debit pricing accordingly based on your history.

Action – Controlling your frequency and indemnity claims will ultimately be reflected in your experience rating.

Operations

Heavier operations would include hardscape construction, tree trimming, and snow removal in which generally heavier machinery and product is used thus a higher exposure to injury. Compare these types of landscape operations to a lighter exposure such as landscape maintenance; mowing, edging and pruning.

Action – Identifying the exposures that are unique to your operations and then implementing safety programs catered to your exposures will help protect your employees. Although your operations might consist of heavier exposures, you have the ability to implement tactics to mitigate the claims from happening and subjectively making your risk profile more appealing. Don’t wait for the injury to occur, be proactive and stop the claim before it transpires.

Your risk profile has already been created whether you know it or not. The opportunity for you to own it and improve it is always available. To look at lowering your workers compensation insurance, take a look at NALP’s new program.

For more information, there will be a free webinar on March 22. Sign up here.

New First Aid Reporting Requirements Take Effect January 1st, 2017

Effective January 1, 2017, employers and insurers will be required to report first aid all claims, according to a recent bulletin from the Workers' Compensation Insurance Rating Bureau (WCIRB).

Effective January 1, 2017, employers and insurers will be required to report first aid all claims, according to a recent bulletin from the Workers' Compensation Insurance Rating Bureau (WCIRB).

To learn more about the changes, visit WCRIB's Bulletin.

Rancho Mesa “Rocks” the Landscape Industry

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

On March 1st 2017 Rancho Mesa Insurance Services, Inc., The National Association of Landscape Professionals, and Berkshire Hathaway Homestate Companies will introduce a unique National Workers Compensation solution designed to cater the needs of Landscape Contractors and Lawn Care Professionals.

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

On March 1st 2017 Rancho Mesa Insurance Services, Inc., The National Association of Landscape Professionals, and Berkshire Hathaway Homestate Companies will introduce a unique National Workers Compensation solution designed to cater the needs of Landscape Contractors and Lawn Care Professionals.

THE AGENCY

Rancho Mesa is a 10 Time National Best Practices Agency out of Santee, California with over 30 years’ experience in The Landscape Industry. As the program manager, Rancho Mesa will look to challenge and develop the growth of the program to better protect its members.

THE CARRIER

Berkshire Hathaway Homestate Companies has the Highest AM Best rating of A++(XV) “Superior” rating of financial strength, and is the one of the largest specialty Work Comp Carriers in the Country.

THE ASSOCIATION

The NALP is the only National Organization built by the collaboration of landscape and lawn care industry professionals and has pushed the boundaries for Professionalism in the Landscape Industry to new heights through; Education, Certification and Legislation. As the voice for 100,000 landscape professionals the NALP passionately advocates for the economic, social and environmental benefits of the landscape industry.

THE PROGRAM HIGHLIGHTS INCLUDE:

• 6% discounted rates for NALP members where allowable. Lowest available base rate in states that do not allow rate deviation.

• Multiple workers compensation options guaranteed cost and small to large deductible.

• Flexible payment plans including stipulated, pay as you go (zero deposit) and monthly payroll reports.

• Quarterly safety webinars specific to the injuries arising out of the landscape industry.

• Dedicated service team with experience in the landscape industry.

• Underwriting team only evaluating NALP members.

• Claims handling dedicated to NALP members with lower caseloads.

• Loss control with regional representation and managed nationally by a dedicated coordinator.

For more information contact Rancho Mesa Insurance Services at NALP@ranchomesa.com.

W-2 Phishing Scam – New Potential Risk to Nonprofits – Be Aware!!

There has been a recent increase in attempts of a phishing scams involving W2s in nonprofit, schools and other human services organizations. We caution any business, but particularity organizations in these sectors to be very cautious if they receive any emails requesting information regarding W2’s, earning summaries or any other employee sensitive information. In many cases these emails look like they originate from a high level employee and are sent to other high level, human resources or payroll department employees.

It has come to our attention that there has been a recent increase in attempts of phishing scams involving W-2 forms in nonprofit, schools and other human services organizations.

Rancho Mesa cautions any business, but particularity organizations in these sectors, to be very cautious if they receive any emails requesting information regarding W-2 forms, earning summaries or any other employee sensitive information. In many cases these emails look like they originated from a high level employee and are sent to other high level, human resources or payroll department employees.

We have included a link to the most recent release from the IRS concerning this issue. Please review it and call us if you have any questions.

Dangerous W-2 Phishing Scam Evolving; Targeting Schools, Restaurants, Hospitals, Tribal Groups and Others

Published February 2, 2017

www.irs.gov/uac/dangerous-w-2-phishing-scam-evolving-targeting-schools-restaurants-hospitals-tribal-groups-and-others

Court Case Endangers State Workers' Comp System

The California Chamber of Commerce recently filed a friend-of-the-court brief in a California Supreme Court case that will determine whether doctors who review workers' comp cases can be sued for certain medical decisions.

Seal of the Supreme Court of California

The Independent Insurance Agents & Brokers of California's (IIABCal) Legislative Update, a compilation of reports produced by IIABCal Lobbyist John Norwood of Norwood & Associates, recently published an update on the possible effects of a court case on the Workers' Compensation System.

Below is an excerpt from the February 6, 2017 Legislative Update article:

The California Chamber of Commerce recently filed a friend-of-the-court brief in a California Supreme Court case that will determine whether doctors who review workers' comp cases can be sued for certain medical decisions.

The brief in King v. CompPartners, Inc argues that the appellate court incorrectly found that utilization review doctors - those who look at records to decide whether a worker's treatment was appropriate, but do not examine the patient personally - have established a physician-patient relationship and therefore owe a duty of care to the injured workers.

Major Implications

If allowed to stand, the decision will create extensive future litigation and can be expected to increase costs that will put upward pressure on malpractice premium rates for all physicians, and have a chilling effect on utilization review physicians, according to the CalChamber.

Establishing potentially unlimited liability for utilization review physicians will potentially lead to higher premiums for employers and could drive future and existing business away from California.

The case also will determine whether medical malpractice claims against utilization review doctors are barred, because all workers' compensation claims are under the purview of the state Division of Workers Compensation. National and statewide insurer groups joined the CalChamber on the brief.

Cal/OSHA 300A Posting Begins February 1st

Rancho Mesa Insurance Services, Inc. would like to remind its clients that February 1, 2017 marks the start of the Cal/OSHA Form 300A posting period. The Cal/OSHA 300A Form is a summary of the company's annual work-related injury and illnesses. It must be posted from February 1, 2017 through April 30, 2017.

Rancho Mesa Insurance Services, Inc. would like to remind its clients that February 1, 2017 marks the start of the Cal/OSHA Form 300A posting period. The Cal/OSHA Form 300A is a summary of the company's annual work-related injuries and illnesses. It must be posted from February 1, 2017 to April 30, 2017.

Who is required to post the Cal/OSHA 300A Form?

Employers with at least 11 employees must post the Cal/OSHA 300A form (though, there are some exemptions for low-hazard industries).

Where must the Cal/OSHA Form 300A be posted?

The Cal/OSHA Form 300A Form must be posted in a conspicuous place within the workplace that is readily available to employees. Employers must also send copies to employees who do not regularly visit the workplace, at least on a weekly basis, where the Cal/OSHA Form 300A form is posted.

Do I need to post the Cal/OSHA Form 300A if we have no work-related injuries or illnesses?

Yes, employers must complete and post the Cal/OSHA Form 300A form even if they have no work-related injuries or illnesses to report.

How do I complete the OSHA Form 300A?

Through Rancho Mesa's Risk Management Center, clients can generate the Cal/OSHA Form 300A using the incident tracking feature, within the system. The form may also be printed and manually completed.

View the Cal/OSHA Form 300A.

Visit www.dir.ca.giv/dosh/etools/recordkeeping/index.html for more information.

California Workers Compensation 2017 Annual Officer Payrolls Minimums and Maximums, Assessment Rates, and Dual Wage Thresholds Announced by WCIRB

ICW Group Insurance Company, the largest group of privately held insurance companies domiciled in California, recently released an announcement that outlines the details and is attached for your review.

ICW Group Insurance Company, the largest group of privately held insurance companies domiciled in California, recently released an announcement that outlines the details of

California Workers Compensation 2017 Annual Officer Payrolls Minimums and Maximums, Assessment Rates, and Dual Wage Thresholds. The document is available for your review.

For any questions concerning the changes, please contact your Rancho Mesa service team.