Industry News

Fraudulent Claims Could Be on the Rise

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

California is in the middle of a construction boom. There is more work than qualified employees and contractors need people on their job sites. While fraudulent workers’ compensation claims are relatively low right now, California contractors are asking what will happen when there is not enough work to keep everyone busy?

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

California is in the middle of a construction boom. There is more work than qualified employees and contractors need people on their job sites. While fraudulent workers’ compensation claims are relatively low right now, California contractors are asking what will happen when there is not enough work to keep everyone busy?

Fraudulent workers’ compensation claims peak when steady work dries up and opportunities diminish. When an employee doesn’t know if they will be employed next week, they can panic and consider making a fraudulent workers’ compensation claim to ensure a compensation check. Regardless of the size of your company, consider how you may be able to create growth opportunities for your employees. Even if an employee is with your company for a short time, it is important to show them there are opportunities for promotions and pay raises. Keeping your employees happy and goal oriented is extremely effective in reducing fraudulent workers’ compensation claims.

According to Chris Dill, Special Investigations Unit Manager for ICW Group Insurance Companies, millennial’s are two to three times more likely to commit workers’ compensation fraud compared to older employees. That is not to say you shouldn’t hire a millennial, just make sure they know there is a path to move up in the company, have job descriptions, and promotions available with new titles. This is essential to keeping their interest and dedication to your company. Make sure to have meetings where every employee can speak freely in an open forum, so their voices are heard. If an employee feels valued and a member of a cohesive team, they are less likely to create false claims, which can lead to a more profitable company.

When bidding for a job, it is next to impossible to account for injuries that may happen and how those injuries will cut into your net profit. If your only goal is revenue, profit is hard to attain and growth is only sustainable if your profit remains consistent. Keeping workers’ compensation claims to a minimum is a contributing factor to achieve consistent profit.

There are many ways to decrease the likelihood of fraudulent workers’ compensation claims. Rancho Mesa Insurance Services offers strategies to help clients stay ahead of this problem, including our upcoming workshop “Fighting Fraud in CA Workers’ Compensation System” on September 19, 2019. Please contact us at (619) 438-6889 or ccraig@ranchomesa.com for more information on how to prevent fraudulent claims, or with any questions you have regarding your policy.

What Does the Employer Do After a Work Injury?

Author, Jim Malone, Workers’ Compensation Claims Advocate, Rancho Mesa Insurance Services, Inc.

A work related injury can be a very traumatic event for the injured worker, but also for their co-workers, employer, family and friends. Some injuries occur from a specific event when everybody knows the injury occurred. Other times, incidents occur during the work day, or repeatedly over time, where the employee needs to report these incidents, accidents or developing symptoms to his supervisor, manager, or human resource manager according to company protocol.

Author, Jim Malone, Workers’ Compensation Claims Advocate, Rancho Mesa Insurance Services, Inc.

A work related injury can be a very traumatic event for the injured worker, but also for their

co-workers, employer, family and friends. Some injuries occur from a specific event when everybody knows the injury occurred. Other times, incidents occur during the work day, or repeatedly over time, where the employee needs to report these incidents, accidents or developing symptoms to his supervisor, manager, or human resource manager according to company protocol.

Prompt reporting of a work injury is very important for the employer and their continued responsibilities. The employee reports the injury or accident to his supervisor, manager, or appropriate employer representative. The employer than has 5 days to report the incident to the insurance carrier.

Once reported, the employer can examine the scene of the accident and verify the mechanism of injury. Witnesses can be identified and their statements can be obtained. If the cause of the accident was another person, that person can be identified and their information can be obtained. If caused by a tool or apparatus, that tool or item can be removed from the work place and kept in a secure area for future reference. If caused by a dangerous condition, the condition can be corrected or barricaded to prevent additional injury.

Work injuries usually result in instances where the injured worker reports the injury to their employer and they are interviewed and referred to an occupational medicine facility. There are companies that provide medical professionals that triage, the injury with the employee via telephone, or a visit to the workplace. The employee may be allowed to drive themselves to this facility or may have to be driven by a supervisor or foreman. The employee is instructed to provide the employer the Work Status form from the physician immediately after each and every examination or follow up visit. If he is released to work, his employer needs the physician’s release to allow a return to work and if they are released to modified duties, the employer then determines if modified work is available. If modified work is not available, the employer than sends the injured worker home until his next visit or until modified work becomes available.

When the injury is addressed, there are forms that need completed for the work related injury. The most important document is the DWC 1 Claim Form. This form MUST be provided to the injured worker within 1 DAY of when the employer knows of the injury. This form starts the claims process with the insurance company. It is a two part form where the employee completes the top part and the employer completes the bottom. Upon completion, the form is submitted to the insurance company and copies are provided to the injured worker and kept by the employer. The employer is then to complete the Employer’s First Report of Occupational Illness of Injury Report (ER’s 5020 form). Then, they obtain the Supervisor’s Report of Work Injury Report and any witness statements that may have been obtained. All these forms and reports are submitted to the insurance adjuster upon receipt and/or completion.

Now that the claim has been created, the employee is obtaining medical treatment, and all the forms have been completed and submitted, the employee’s progress will be monitoring during their recovery. Maintaining good communication with the employee and claims adjuster is very important for helping the employee get through this recovery process.

For additional information, please contact Rancho Mesa Insurance Services, Inc. at (619) 937-0164.

Higher Workers' Compensation Premiums Linked to New Employee Injuries

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

Based on Rancho Mesa Insurance Services’ client’s information, we have been able to identify that the majority of work-related injuries occur within the first year of employment. During the first year, the majority of these claims occur in the first six months. Having a system for onboarding and training new hires is a critical component to dealing with the heightened risk of injury during this time period.

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

Based on Rancho Mesa Insurance Services’ clients’ information, we have been able to identify that the majority of work-related injuries occur within the first year of employment. During the first year, the majority of these claims occur in the first six months. Having a system for on-boarding and training new hires is a critical component to dealing with the heightened risk of injury during this time period.

New Hires Effect Risk Exposure

During the workers’ compensation underwriting process, companies are commonly asked if their payroll will continue to grow, stabilize, or decline. Underwriters can assume that with growing payrolls, the company will be hiring new employees. New employees will likely increase the probability of work-related injuries. Underwriters must take this information into consideration when justifying a premium that will cover the company’s complete risk exposure.

Mitigating the Increase in Premium

It is extremely beneficial for the owner and insurance broker to relay the measures that their company has committed to train, manage, and track new hires. If you are looking for a way to improve your safety efforts, consider focusing on proper new employee onboarding and training to minimize the potential impact claims can have on your company.

Please reach out to Rancho Mesa’s Client Services Coordinator Alyssa Burley at (619) 438-6869 to learn more about the Risk Management Center and how you can improve your safety training.

The Ticking Time Bomb for Plumbing and Mechanical Contractors: Lower Expected Loss Rates Can Mean Higher Experience Modifications

Author, Kevin Howard, CRIS, Account Executive, Rancho Mesa Insurance Services, Inc.

The Workers Compensation Insurance Rating Bureau (WCIRB) released the 2019 Expected Loss Rates (ELR’s) in the 4th quarter of 2018. The ELR’s in the plumbing class code 5187 dropped 17% on January 1st 2019. This decrease is not getting significant attention, but could potentially create negative implications for California plumbing contractors and their respective experience modifications in 2019, 2020 and beyond.

Author, Kevin Howard, CRIS, Account Executive, Rancho Mesa Insurance Services, Inc.

The Workers Compensation Insurance Rating Bureau (WCIRB) released the 2019 Expected Loss Rates (ELRs) in the 4th quarter of 2018. ELRs are the average rate at which losses for a classification are estimated to occur during an experience rating period. They are generally expressed as a ratio per $100 of payroll and can often have a dramatic impact on experience modifications. To support this point, the ELRs in the plumbing class code 5187 dropped 17% on January 1, 2019. This decrease is not getting significant attention, but could potentially create negative implications for California plumbing contractors and their respective experience modifications in 2019, 2020, and beyond. All plumbing and mechanical contractors should be made aware so they can prepare and make changes to protect themselves from the impact. Similar to a leak behind a wall, this could go undetected until the experience mods are released and then it is too late and too much damage has been done.

LINKING ELRs WITH YOUR PRIMARY THRESHOLD

The lowered expected loss rates also impact primary thresholds. Your primary threshold is the maximum primary loss value for each individual worker’s compensation claim. If primary thresholds move lower, one small lost time claim can cause a significant spike in an experience modification. An elevated experience modification can impact not only pricing, but opportunities to bid certain types of work within the commercial sector.

WHAT CAN YOU DO TO GET OUT IN FRONT OF THIS?

If these terms are completely new to you and your organization, lean on your insurance broker to provide the education needed to get up to speed. That can start with building a detailed service plan that focuses on controlling your experience modification. Some examples of critical elements that should be discussed would include:

Addressing open reserves on claims that are impacting the future experience modification.

How the timing of the unit stat filing will affect the future experience mod and cost.

Ensuring that your safety program addresses the root cause of claim frequency and severity.

Trainings that are aligned with OSHA compliance.

Experience MOD forecasting up to 7 months prior to your firm’s effective date.

AVOIDING THE TICKING TIME BOMB

The ticking time bomb can be avoided by taking certain steps and actions that are strategically put in place with your insurance broker. If this article has created concern and/or these terms are brand new to you, pick up the phone and schedule an experience modification control meeting with an advisor from Rancho Mesa at (619) 937-0164. Their Best Practices approach to managing risk starts with a client-centric process that is focused on education and execution.

California SB 1343 Expands Sexual Harassment and Abusive Conduct Prevention Training Requirements

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

In September 2018, former California Governor Jerry Brown approved Senate Bill 1343 (SB 1343) which expands the requirements for Sexual Harassment and Abusive Conduct Prevention training within the workplace.

Editor’s Note: This article was originally published on January 17, 2019 and has been updated for accuracy on September 12, 2019.

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

In September 2018, former California Governor Jerry Brown approved Senate Bill 1343 (SB 1343) which expands the requirements for Sexual Harassment and Abusive Conduct Prevention training within the workplace.

New Requirements

Prior to SB 1343, California Assembly Bill 1825, Assembly Bill 2053, and State Bill 396, required employers with 50 or more employees to provide supervisors with sexual harassment and abusive conduct prevention training every two years. SB 1343 drops the minimum number of employees to 5 and adds a requirement for training nonsupervisory employees.

According to Senate Bill 778, passed on August 30, 2019 which expands the training deadline, “By January 1, 2021, an employer having five or more employees shall provide at least two hours of classroom or other effective interactive training and education regarding sexual harassment to all supervisory employees and at least one hour of classroom or other effective interactive training and education regarding sexual harassment to all nonsupervisory employees in California. Thereafter, each employer covered by this section shall provide sexual harassment training and education to each employee in California once every two years.”

The changes made by SB 778 not only extends the due date to January 1, 2021, but also addresses concerns about supervisory employees and clarifies when temporary workers must be trained. Read about the changes here.

Providing Training

The bills also requires the California Department of Fair Employment and Housing (DFEH), “develop or obtain two online training courses on the prevention of sexual harassment in the workplace. The course for nonsupervisory employees shall be one hour in length and the course for supervisory employees shall be two hours in length.” The department “expects to have such trainings available by late 2019,” according to a document provided by the DFEH. The online trainings are expected to be free for employers.

“In the interim period, DFEH is offering a sexual harassment and abusive conduct prevention toolkit, including a sample sexual harassment and abusive conduct prevention training. Employers may use the training in conjunction with an eligible trainer to provide sexual harassment and abusive conduct prevention training,” according to the DFEH.

An eligible trainer qualified to conduct this training would be:

Attorneys who have been members of the bar of any state for at least two years and whose practice includes employment law under the Fair Employment and Housing Act or Title VII of the federal Civil Rights Act of 1964;

Human resource professionals or harassment prevention consultants with at least two years of practical experience in:

Designing or conducting training on discrimination, retaliation, and sexual harassment prevention;

Responding to sexual harassment or other discrimination complaints;

Investigating sexual harassment complaints; or

Advising employers or employees about discrimination, retaliation, and sexual harassment prevention.

Law school, college, or university instructors with a post-graduate degree or California teaching credential and either 20 hours of instruction about employment law under the FEHA or Title VII.

Note, DFEH does not issue licenses nor certificates validating a person’s qualifications to teach sexual harassment prevention training classes.

Other training options include the online Anti-Harassment training Rancho Mesa offers to all of its clients’ supervisors and employees throughout the country in response to California’s Senate Bill 1343 (SB 1343) and Senate Bill 1300 (SB 1300).

We also can recommend Equal Parts Consulting to provide in-person supervisor and/or employee training to those in San Diego and Orange Counties. To receive a discounted rate, please let them know you are a Rancho Mesa Insurance client.

Rancho Mesa Insurance will continue to monitor training options as they become available.

For questions about this training requirement or to learn how to enroll your supervisors and employees, register for the “How to Enroll Supervisors and Employees in the Online Anti-Harassment Training” webinar or contact Rancho Mesa’s Client Services Department at (619) 438-6869.

Resources

California Department of Fair Employment and Housing. "Sexual Harassment and Abusive Conduct Prevenetion Training Information for Employers.”

https://www.dfeh.ca.gov/wp-content/uploads/sites/32/2018/12/SB_1343_FAQs.pdf

California Department of Fair Employment and Housing. “Sexual Harassment FAQs.”

https://www.dfeh.ca.gov/resources/frequently-asked-questions/employment-faqs/sexual-harassment-faqs/

Reporting Serious Workers’ Compensation Injuries

Author, Jim Malone, Workers’ CompensationClaims Advocate, Rancho Mesa Insurance Services, Inc.

Workers’ Compensation injuries occur every day. The majority of these injuries are minor incidents which require no medical treatment or loss of time from work. For others, the injury is reported to the insurance carrier, the injury is addressed, forms are provided, and the recovery from the injury is monitored until the employee is released back to work and a discharge from care is provided.

Author, Jim Malone, Workers’ CompensationClaims Advocate, Rancho Mesa Insurance Services, Inc.

Workers’ Compensation injuries occur every day. The majority of these injuries are minor incidents which require no medical treatment or loss of time from work. For others, the injury is reported to the insurance carrier, the injury is addressed, forms are provided, and the recovery from the injury is monitored until the employee is released back to work and a discharge from care is provided.

However, serious injuries, illnesses or even deaths occasionally occur at work because of a work related accident. These incidents usually require 911 calls, hospitalizations, emergency surgeries, family contact, and a longer road to recovery. They may also require immediate (within 8-24 hours) reporting to the California Occupational Safety and Health Administration (Cal/OSHA), if they meet the criterion that has been established.

As defined in the California Code of Regulations Title 8 §330(h), serious injury or illness means any injury or illness occurring in a place of employment, or in connection with any employment that:

Requires inpatient hospitalization for a period in excess of 24 hours for other than medical observation.

Results in a loss of any member of the body.

Results in a serious degree of permanent disfigurement.

Results in the death of the employee.

Does not include any injury, illness, or death caused by the commission of a Penal Code violation, except the violation of Section 385 of the Penal Code, or an accident on a public street or highway.

The California Code of Regulations Title 8 §342(a) states, “every employer shall report immediately by telephone or telegraph to the nearest District Office of the Division of Occupational Safety & Health any serious injury or illness, or death, of an employee occurring in a place of employment or in connection with any employment. Immediate means as soon as practically possible but not longer than 8 hours after the employer knows or with diligent inquiry would have known of the serious injury or illness. If the employer can demonstrate that exigent circumstances exist, the time frame for the report may be made no longer than 24 hours after the incident.”

The 8-24 hour time frame begins when the employer knows, or “with diligent inquiry” would have known of the serious injury, illness, or death. The “employer” means someone in a management or supervisory capacity.

As with any injury or accident, it can be a difficult and confusing time for all those involved and affected. It may seem like many things need to be done all at once. That is, of course, impossible. So, prepare yourself now. Make a list of your responsibilities and important contact numbers before a serious injury or accident occurs.

The order in which you perform each of these responsibilities may differ, according to the type of injury or accident that occurs. However, you will still have your checklist and contact numbers ready to use to ensure you do not forget any particular step or obligation. This emergency list of telephone numbers may be your broker, safety/loss control specialist, claims administrator, or workers’ compensation claims advocate. We are all available to provide you with any assistance you may need.

For those in California, the Cal/OSHA District Office contact list is below. Ask for the officer of the day.

Concord (925) 602-6517

Oakland (510) 622-2916

San Francisco (415) 972-8670

Cal/OSHA Link: www.dir.ca.gov/title8/342.html

For additional information, please contact Rancho Mesa Insurance Services, Inc. at (619) 937-0164.

Developing an Effective Injury and Illness Prevention Program (IIPP)

Author, Daniel Frazee, Executive Vice President, Rancho Mesa Insurance Services, Inc.

If you have operated a business in the state of California for any period of time, you have very likely heard about or run across the acronym IIPP. Wherever you stand with your knowledge within the world of safety, injury, and illness, it is important for every organization to understand the mandatory parts of an IIPP. What is often overlooked is how developing an effective safety program can create positive change and truly impact your bottom line.

Author, Daniel Frazee, Executive Vice President, Rancho Mesa Insurance Services, Inc.

If you have operated a business in the state of California for any period of time, you have very likely heard about or run across the acronym IIPP. Wherever you stand with your knowledge within the world of safety, injury, and illness, it is important for every organization to understand the mandatory parts of an IIPP. What is often overlooked is how developing an effective safety program can create positive change and truly impact your bottom line.

What is an IIPP?

An Injury and Illness Prevention Program (IIPP) is a required written workplace safety document that must be maintained by California employers (Title 8 of the CA code of regulations, section 3203). These regulations require eight (8) specific elements that are summarized below. In many cases, this process requires direct questions about how the company currently views and manages safety. Answering these questions will begin to highlight the positive aspects of what already is currently in place and shed light on areas that need improvement.

Responsibility

Clarifying the name, title and contact information for the person(s) with overall responsibility for the IIPP is a critical first step to this process. Making the IIPP available and accessible at all business locations becomes the first task of the “responsible person.”

Compliance

What is the content of the company’s safety meetings? Who runs those meetings? How do you discipline employees if they do not follow safety guidelines? How might the company recognize or reward their employees for safe practices or behavior?

Communication

Safety meetings are held on what type of schedule within your organization? How can employees anonymously notify management of safety and health concerns without fear of reprisal? Is there a safety committee in place that provides communication to all employees? If not, who would be considered as important members of that committee?

Hazard Assessment

Who within the company is responsible for periodic inspections to identify and evaluate workplace hazards? Provide detail on this schedule along with accompanying documentation that these visits occurred. Continuously communicating with employees for feedback and constantly reviewing hazards on a jobsite or within the workplace are crucial. Lastly, does the company use a standard or tailored JHA (Job Hazard Analysis) checklist to accomplish this? Re-visiting these checklists regularly as exposures change is critical to reducing claim frequency.

Accident/Exposure Investigation

Post-accident, who is the name of the person within the organization responsible for conducting those investigations? What type of form or checklist are you using to establish “root causes” of the accident or injury? And, back to the compliance section, what type of discipline could be handed down in the event of employee error that causes an accident or injury?

Hazard Correction

After the company has identified the hazard and determined exactly how and why an incident occurred, the IIPP must provide detail on how the company will correct the problem from happening again. One solid first step can include a review of Personal Protective Equipment (PPE) use. That is, did the equipment being used cause the accident or injury and, if yes, why? Answering the\is question may show that the piece of equipment was not appropriate for the task, or the item was defective or too old, which caused failure.

Training and Instruction

Ongoing and job specific training and instruction are really the lifeblood of any truly effective IIPP. Presenting the information in a clear, concise format that is easily understood is often the most difficult task in this process. Yet, it remains perhaps the most important as it is vital that employees are continually educated and RETAIN their instruction. Peeling back this process with managers, foreman, superintendents, etc. and learning specifically how the training is being disseminated, allows for a true baseline to be established.

Recordkeeping

Document, document, document! While establishing a written version of the IIPP might be the first step, and revising/editing on an annual basis is recommended, having the proper documentation that accompanies each section is just as important. This provides the responsible person(s) an important tool to continually compare the company’s actions, trainings, assessments and prevention techniques with the available documentation.

Can An Effective IIPP Impact my Bottom Line?

Building an effective IIPP means that the document represents a part of the company’s culture. For it to be meaningful and have a real impact on reducing workplace injuries and illnesses, it must reflect what your company is actually doing on a day to day basis. As the company’s ownership ties this into the overall business, building the IIPP from the ground up into a living, breathing document has measurable impact on controllable costs like workers’ compensation. Reducing frequency of injury can help lower the experience modification, improve the loss ratio, and establish a solid risk profile in the insurance marketplace. Having the supporting documentation along with specific examples of forms, checklists and assessments can arm an insurance broker with the tools they need in the marketplace. More specifically, this information provides a broker important leverage points when negotiating the most competitive terms possible for the employer with the insurance carrier’s underwriter. Those points can lead directly to premium savings, which leads to healthier margins and stronger profitability. Build the IIPP because it is a CA state requirement and it is the right thing to do. But, believe that building a first class safety program will absolutely lower your long-term insurance costs.

For a sample IIPP, visit the Risk Management Center or contact Alyssa Burley at (619) 438-6869.

Six Reasons for Promptly Reporting a Workers’ Compensation Claim

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

Reporting workers’ compensation claims in a timely manner can have a huge impact on the severity of the claim. Some policyholders believe the practice of not reporting employee injuries early is a good business practice. This could not be further from the truth.

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

Reporting workers’ compensation claims in a timely manner can have a huge impact on the severity of the claim. Some policyholders believe the practice of not reporting employee injuries early is a good business practice. This could not be further from the truth. Below are six reasons why reporting claims early can reduce the overall impact of a claim on an employer’s insurance premiums:

Lowers the cost of a claim – The cost of a claim gets higher and higher for each day it is not reported. Claims reported after 30 days of the injury on average cost 30% more than those reported right away.

Ensures that key evidence is secured – The prompt reporting of a claim allows the claims adjuster to ensure key evidence is preserved. It also ensures that the supervisor’s accident report and witness statements are taken while things are still fresh in their minds.

Potential hazards are identified as early as possible – When an injury or near miss occurs, there should be an accident investigation completed to find out the root cause of the injury. Identifying the cause or potential hazard will reduce the likelihood of a similar claim from occurring in the future. It can also be useful as a training topic during safety-related meetings.

Could identify “red flags” for fraud – It is very important to understand that an insurance company only has 90 days from the employer’s (or their management or supervisors) date of knowledge to accept or deny a claim. If the claim is reported late, it leaves the adjuster little time to investigate the validity of a claim, which might force them to accept it. If the claim is reported 90 or more days after the date of knowledge, the adjuster has no choice but to accept the claim. The impact of a fraudulent claim can have a significant effect on future workers’ compensation pricing.

Reduces litigation – When an injury claim is not reported in a timely manner by the employer, it can make the injured employee feel neglected or disgruntled. Reporting the claim early, showing compassion towards the employee, and keeping the lines of communication open will significantly reduce the likelihood of a litigated claim. Employees need to feel they are going to be taken care of medically and still have a job at the company. Employees are more likely to hire an attorney when they feel uneasy about their job security or they are not receiving proper treatment. When a claim becomes litigated, it typically prolongs the time it takes to close the claim and increases the cost by an average of 30%.

Untreated medical only injuries could develop into indemnity claims – A small percentage of medical only claims can turn into indemnity claims as a result of unforeseen complications. For example, if an employee has a small metal shard stuck in their finger and chooses not to receive treatment, the finger could become infected, require surgery, and ultimately cause nerve damage. Had this injury been properly treated from the beginning, it likely would have simply been a first aid claim. Early treatment is key to minimizing indemnity claims.

Quickly reporting claims is simply one risk management strategy to controlling a business’s insurance costs. To discuss this strategy and others please feel free to contact Rancho Mesa Insurance at 619-937-0174.

California Insurance Commissioner Announces Rate Cuts for 2019

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

California employers received some great news regarding their Workers Compensation premiums for 2019. On November 6, 2018, Insurance Commissioner Dave Jones recently announced his decision to cut California Workers’ Compensation advisory pure premium rates by 8.4% significantly higher than the initial recommended 4.5%. This change will affect policies that renew or incept on or after January 1, 2019.

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

California employers received some great news regarding their Workers Compensation premiums for 2019. On November 6, 2018, Insurance Commissioner Dave Jones recently announced his decision to cut California Workers’ Compensation advisory pure premium rates by 8.4% significantly higher than the initial recommended 4.5%. This change will affect policies that renew or incept on or after January 1, 2019.

To learn more about how this decrease will affect your company’s workers’ compensation premium in 2019, contact Rancho Mesa Insurance Services at (619) 937-0164.

2019 Expected Loss Rates Published in California’s Updated Regulatory Filing – X-MOD Impact Inevitable for 0042 Class Code

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

The 2019 Expected Loss Rate (ELR) for Landscaping class code 0042 was recently published at a 15% decrease or $2.97.

The ELR is the factor used to anticipate a class code’s claim cost per $100 for the experience rating period. It is not to be confused with the Pure Premium Rate (PPR). The ELR differs from the PPR in that the ELR simply measures the basic claim cost for a class code without including loss adjustment expense, excess loss load (capped at $175,000 for X-MOD purposes), and loss development.

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

The 2019 Expected Loss Rate (ELR) for Landscaping class code 0042 was recently published at a 15% decrease or $2.97.

The ELR is the factor used to anticipate a class code’s claim cost per $100 for the experience rating period. It is not to be confused with the Pure Premium Rate (PPR). The ELR differs from the PPR in that the ELR simply measures the basic claim cost for a class code without including loss adjustment expense, excess loss load (capped at $175,000 for X-MOD purposes), and loss development. The PPR includes all of the mentioned above factors and is the rate for which a carrier can expect to pay for all of the cost associated with claims in a specific industry. The PPR does not account for the carrier’s overhead, profit, tax, and commissions.

Under most circumstances, when you hear the word decrease as associated with insurance its a good thing, but in the case of the ELR, a decrease will have a negative impact on your Experience MOD (X-MOD). In simple terms, if your losses stay the same and the ELR for your industry is down 15%, your X-MOD is going to go up.

At 15%, the landscape class code accounts for one of the largest swings in the 2019 regulatory filing for all industries. This only reinforces the importance of mitigating claim frequency, superior carrier claims handling, internal claims advocacy, claim cost consolidation efforts, and a proven system to keep all of these aspects running constantly. Fortunately, Rancho Mesa has a system in place today and it is a proven success.

Don’t be caught off guard in 2019; have a plan and always anticipate for the future. Let Rancho Mesa help manage your landscape insurance needs. For more information, call (619) 937-0164.

Distracted Driving, Not Just an Automobile Insurance Issue, Bad News for Workers Compensation Too

Author, David J Garcia, A.A.I, CRIS, President, Rancho Mesa Insurance Services, Inc.

I’ve written at length on the negative effects distracted driving is having on the automobile insurance industry and its impact on the rise in accidents, claim costs, and increases to your automobile premiums. But, have you considered its effects on your Experience Modification Rate (EMR) and ultimately workers’ compensation cost?

Author, David J Garcia, A.A.I, CRIS, President, Rancho Mesa Insurance Services, Inc.

I’ve written at length on the negative effects distracted driving is having on the automobile insurance industry and its impact on the rise in accidents, claim costs, and increases to your automobile premiums. But, have you considered its effects on your Experience Modification Rate (EMR) and ultimately workers’ compensation cost?

When one of your employees is injured in an automobile accident while working on your behalf, Arising out of Employment (AOE) / Course of Employment(COE) their sustained injury will be covered by your workers’ compensation policy, regardless of fault.

“Regardless of fault?!”

When a third party is deemed at fault and the injuries to your employee(s) have been settled, your workers’ compensation insurance carrier may “subrogate” their costs to the carrier representing the at fault driver. Now, here is the realty – studies have shown that 14.7% (4.1 million) of all California drivers are uninsured, while another large percentage of drivers hold the California minimum limits of $15,000/$30,000. What this means is that even if subrogation is a possibility, the likelihood of a “full” recovery is not probable. Thus, all the costs of the injury to your employee(s) will likely be the sole responsibility of your workers’ compensation carrier and this claim cost negatively affects your EMR and loss ratios for years to come.

What can you do?

You can implement a strong fleet safety program that includes a policy pertaining to distracted driving. When your employee is involved in a motor vehicle accident, adherence to your company’s accident investigation protocol is crucial. Documentation will prove pivotal for your carrier if subrogation becomes a possibility.

For our clients, through RM365 Advantage, we have a number of resources: fleet safety programs that can be customized, fleet safety training topics, fillable and printable accident investigation forms, archived fleet safety workshop videos, and more, in both English and Spanish. You can access this through our RM365 Advantage Risk Management Center or contact our Client Services Coordinator Alyssa Burley at aburley@ranchomesa.com.

If you are not a current client of Rancho Mesa, we encourage you to reach out to your broker for assistance or email Alyssa Burley to get additional information or to ask any questions.

Fleet Safety: Four Steps to Effective-Driver Selection

Author, Sam Clayton, Vice President Construction Group, Rancho Mesa Insurance Services, Inc.

Driver selection guidelines are one of the most important things a company can implement to prevent vehicle accidents. A company should manage a written Motor Vehicle Records (MVR’s) program to assure that they are selecting the right employees to drive for the company and annually qualify each driver for desirable driving records. The following are some “best practices” guidelines that will help businesses implement and improve the driver selection process.

Author, Sam Clayton, Vice President Construction Group, Rancho Mesa Insurance Services, Inc.

Driver selection guidelines are one of the most important things a company can implement to prevent vehicle accidents. A company should manage a written Motor Vehicle Records (MVR’s) program to assure that they are selecting the right employees to drive for the company and annually qualify each driver for desirable driving records. The following are some “best practices” guidelines that will help businesses implement and improve the driver selection process.

Step 1: Determine who drives for the company.

The first thing a business must do to control driver selections is knowing who is driving on behalf of the company. Most companies have drivers that fall into several categories:

Non-employees operating company vehicles

Drivers of vehicles owned or leased by the company

Drivers with a Commercial Drivers License (CDL)

Employees driving their own vehicle for company business

Step 2: Establish specific requirements depending on whose is driving.

For all employees, regardless if they are operating a company owned or leased vehicle, the company must:

Verify the person has a valid Driver License.

Determine that the license is appropriate for the type of vehicle they will be operating.

Request a copy of their Motor Vehicle Record (MVR) and compare it to the acceptable criteria before they drive for the company, and again on an annual basis.

For drivers of vehicles owned or leased by the company, it is wise to ask for a:

Completed written application that includes a section that lists all driving violations and/or accidents within the last 3 years.

Substance abuse test (optional).

For drivers with a Commercial Driver License:

Conduct a Department of Transportation (DOT) physical examination.

Create a driver qualification file for each driver that complies with DOT.

Conduct a drug test for each driver, following DOT regulations (pre-hire, random, post-accident and suspension).

For employees using their own vehicles for company business:

Require proof of insurance.

Establish minimum personal limits of insurance. Rancho Mesa recommends a minimum of $100,000/$300,000/$100,000.

Step 3: Establish MVR Qualification Process

Managing the driver selection and ongoing qualification process is the employer’s responsibility. There is a broad range of driving violations that can be classified into two major categories “A” and “B.”

Category “A” would include driving under the influence of drugs, refusing to take a substance test, reckless/careless driving, speeding in excess of 14mph over the posted speed limit, texting, hit and run, speeding in a school zone, racing, driving with a suspended or revoked license, vehicular assault etc.

Category “B” would include, speeding 1-14 mph over posted speed limit, improper lane change, failure to yield, failure to obey traffic signal or sign, accidents, having a license suspended in the past for moving violations, etc.

Best practices for MVR qualifications include:

Anyone with a type “A” driving violation in the last five years is undesirable for a driving position.

Anyone with three or more type “B” violations, or two or more at fault accidents in a three-year period, is undesirable for a driving position.

Anyone with two type “B” moving violations, or one driving accident in the last three-year period, should be put on warning and MVR’s reviewed semi-annually.

In addition to the initial MVR check upon hire, all employees who routinely drive their personal vehicle on company business should have their MVR screened at least once every 12 months to ensure their driving record remains acceptable.

Step 4. Enroll all employees in the DMV Pull Notice Program.

For a nominal annual fee, employers can enroll in the Department of Motor Vehicles' Pull Notice Program. This service provides employers with a notice of any moving violations within 24 hours. So, an employer will know right away if one of their drivers' records has changed. Not participating in the program makes the company vulnerable to going months with an unqualified driver before an annual MVR review is completed.

Following these best practices for effective driver selection takes the guest-work out of determining who should drive for a company. Following these four steps can help ensure the company has qualified drivers at all times.

For questions about driver selection, contact Rancho Mesa Insurance Services, Inc. at (619) 937-0164.

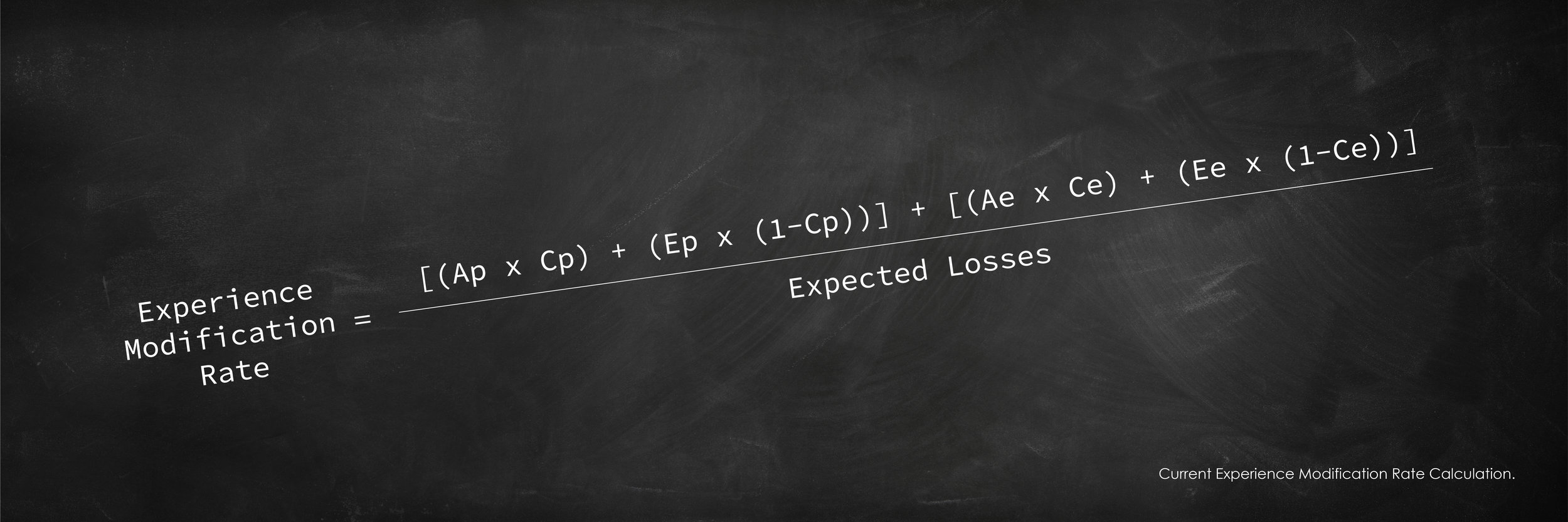

Changes in the 2019 Experience Modification Formula – Are You Ready? (Part 2)

Author, David J. Garcia, A.A.I, CRIS, President, Rancho Mesa Insurance Services, Inc.

As we approach 2019, there will be several changes in the experience modification formula that directly affects the calculation of an employer's 2019 Experience Modification Rate (EMR).

Part 1 of this article describes the Primary Threshold and Expected Loss Rate. Read Part 1 of this article. Part 2 provides an overview of the changes to the EMR calculation.

Author, David J. Garcia, A.A.I, CRIS, President, Rancho Mesa Insurance Services, Inc.

As we approach 2019, there will be several changes in the experience modification formula that directly affects the calculation of an employer's 2019 Experience Modification Rate (EMR).

Part 1 of this article describes the Primary Threshold and Expected Loss Rate. Read Part 1 of this article. Part 2 provides an overview of the changes to the EMR calculation.

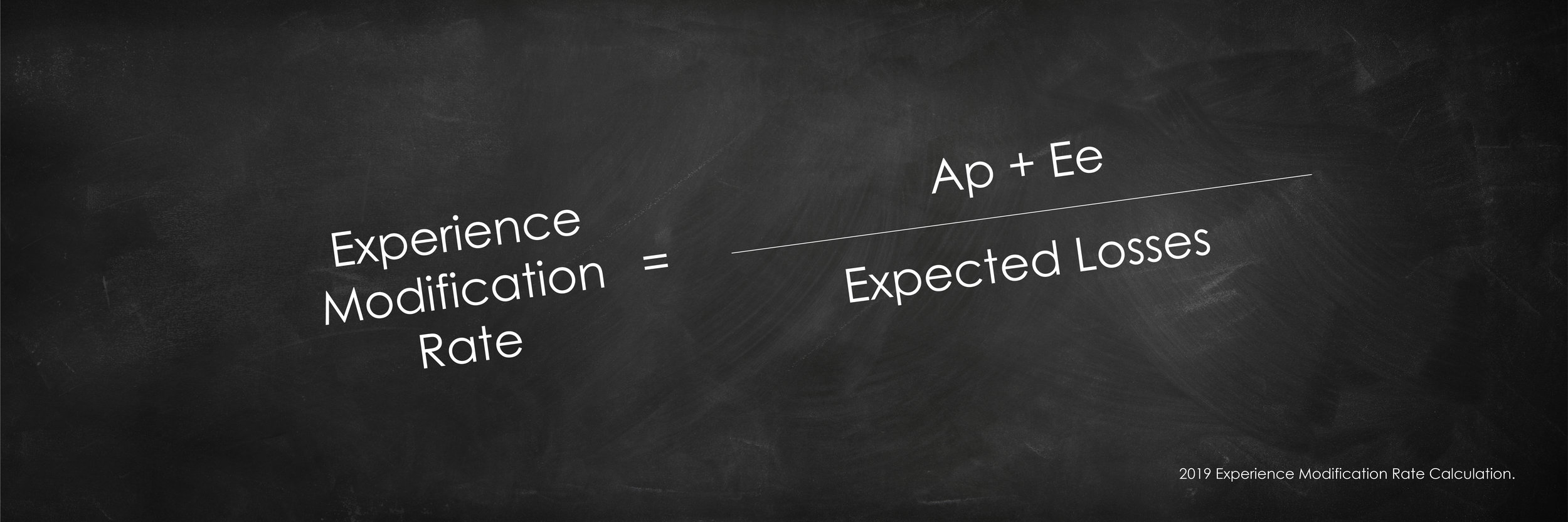

The Simplified Formula

Individual claim cost (i.e., both paid and reserved) will go into the calculation up to the primary threshold limit are considered the actual primary losses. Any claim cost that exceeds your primary threshold is considered the actual excess loss. In past experience mod formulas, the actual excess loss was used in the factoring of your EMR; in 2019, it will have no effect. However, under the new calculation, the industry expected excess losses will be considered in the 2019 simplified formula.

Actual Primary Losses + Expected Excess Losses / Expected Losses

The expected excess losses are calculated by multiplying your class code’s payroll per $100 by the expected loss rate for that same class code. This number is then discounted by the “D Ratio” to determine expected primary losses and expected excess losses. There are 90 different D-Ratios for each classification based on the primary threshold. The D-Ratio is different for each classification and is determined by the severity of injuries that occur within that particular class code.

The first $250 of all claims will no longer be used in the calculation of your EMR.

This is a major change and one that was initiated in part to encourage all employers to report all claims, including those deemed first aid, without having a negative impact on the companys’ EMR. This change will affect all claims within the 2019 calculation; so yes, it will include years previously completed and reported. This will have a positive impact on EMRs in that claim dollars will be removed from the EMR calculation.

Confused – Want more details?

Help is on the way. We are going to hold a statewide webinar on Thursday, October 4th at 9:00am in order to dig deeper into this subject and answer specific questions. You may register for the webinar by contacting Alyssa Burley at (619) 438-6869 or aburley@ranchomesa.com.

Changes in the 2019 Experience Modification Formula – Are You Ready? (Part 1)

Author, David J. Garcia, A.A.I, CRIS, President, Rancho Mesa Insurance Services, Inc.

As we approach 2019, there will be several changes in the experience modification formula that directly affects the calculation of an employer's 2019 Experience Modification Rate (EMR). Sadly, most businesses are both unaware and unprepared.

Author, David J. Garcia, A.A.I, CRIS, President, Rancho Mesa Insurance Services, Inc.

As we approach 2019, there will be several changes in the experience modification formula that directly affects the calculation of an employer's 2019 Experience Modification Rate (EMR). Sadly, most businesses are both unaware and unprepared.

Before we breakdown the changes to the 2019 EMR formula, we must first have a strong understanding of the two critical components that directly affect the outcome of the EMR. This article will be broken out into 2 parts. Part 1 will describe the Primary Threshold and Expected Loss Rate. In Part 2, I will provide an overview of the changes to the EMR calculation.

The single most important number to my EMR is not my final rating?

Primary Threshold

Rancho Mesa has long taken a stance on the importance of a business owner knowing their primary threshold as it relates to the EMR. Proactive business owners should monitor their primary threshold annually as it is subject to change due to payroll fluctuations, operations, and the annual regulatory filing of the expected loss rate. In general terms, the more payroll associated with your governing class (the class code with the preponderance of your payroll) the higher your primary threshold will be. The primary threshold is unique to every business. The 2019 EMR formula is heavily weighted by the company's actual primary losses, the claim cost (both paid and reserved) that goes into the calculation up the primary threshold amount. Controlling claim cost and knowing your company's primary threshold is the first step to understanding the EMR.

Expected Loss Rates

The expected loss rate is the factor used to anticipate a class code's claim cost per $100 for the experience rating period. The expected loss rate (ELR) is not to be confused with the pure premium rate (PPR). The ELR differs from the PPR in that the ELR simply measures the basic claim cost for a class code without including loss adjustment expense, excess loss load (capped at $175,000 for X-MOD purposes), and loss development. The PPR includes all of the mentioned above factors and is the rate for which a carrier can expect to pay all of the cost associated with claims in a specific industry. The PPR does not account for the carrier’s overhead, profit, tax, and commissions.

The ELR changes, annually. It’s important to monitor the change; if your expected loss rates go down (from our analysis this is the direction most are going) and if nothing else changes, your EMR will go up. Why is this? Again, without going too deep, in simple terms, your EMR is a ratio of actual losses to expected losses. If your expected losses go down, but your actual losses remain the same, then your EMR will go up.

To illustrate this, consider the following. Actual losses are $25,000 and your expected losses are $25,000 your EMR would be 100. Now, if your actual losses stay the same at $25,000, but your expected losses drop to $20,000, your EMR would now be 125%. (There are other factors that would go into the actual calculation, so your actual EMR would be different – this was just to illustrate the expected losses impact to the EMR.)

In Part 2 of this article, will cover the actual changes to the EMR calculation.

For more information about the EMR, contact Rancho Mesa Insurance Services at (619) 937-0164.

Differentiating Solar Industry Class Codes

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

Research conducted by the Solar Energy Industry Association (SEIA) shows that California benefits from roughly 3,000 solar contractors conducting business in the state. Panels are being installed at a rapid rate. In fact, statistics show that as of January 2018, over 5 million California homes have “gone solar” and that number continues to grow. There are other benefits to using solar panels to harvest energy besides just generating electricity. They can also be used to heat water in pools, spas, storage tanks and other plumbing systems using hot water solar panels.

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

Research conducted by the Solar Energy Industry Association (SEIA) shows that California benefits from roughly 3,000 solar contractors conducting business in the state. Panels are being installed at a rapid rate. In fact, statistics show that as of January 2018, over 5 million California homes have “gone solar” and that number continues to grow. Not only are solar panels used to generating electricity, they can also be used to heat water in pools, spas, storage tanks and other plumbing systems using hot water solar panels.

With solar installation of all kinds becoming more prevalent throughout California, contractors must understand which workers' compensation classification is most applicable for their specialty.

California’s Workers' Compensation Insurance Rating Bureau (WCIRB) breaks down solar installation into two categories: (1) Hot water solar collection panel install, service and repair, and (2) Photovoltaic (PV) solar panel install, service and repair.

Hot Water Solar Collection Panel Install, Service and Repair

Hot water solar collection panels absorb solar energy to heat water or to transfer fluid that circulates through panels. This hot water is then routed through pipes to pools, spas, storage tanks or hydraulic heating systems. The installation, service or repair of solar water panels is assigned to workers' compensation class code 5183/5187 for plumbing.

PV Solar Panel Install, Service, and Repair

This classification applies to the outside installation, service or repair of electrical machinery or auxiliary apparatus, including but not limited to automated security gates, transformers, generators, control panels, temporary power poles at construction sites, industrial fans or blowers, photovoltaic solar panels, wind powered generators and industrial x-ray machines. Contractors who are installing, servicing or repairing PV solar panels will be assigned to the class code 3724(2) in electrical machinery or auxiliary apparatus.

The workers compensation base rates for each of these two class codes can vary widely from one carrier to another. Solar installation exposures, a detailed description of operations, and appropriate safety measures utilized must be clarified with your insurance broker so that your firm is properly placed in the appropriate code. The difference can often represent significant savings.

Rancho Mesa Insurance Services, Inc. has expertise in the solar contracting arena, representing clients that cross into both categories. Consider Rancho Mesa for a policy review and audit in advance of your next insurance renewal.

Update: 8868 Class Code Changes - Proposed WCIRB Changes Awaiting Public Hearing August 3rd

Author, Chase Hixson, Account Executive, Human Services Group, Rancho Mesa Insurance Services, Inc.

On August 3, 2018, the California Department of Insurance will hold a public hearing regarding the proposed changes to the 8868 Class Codes.

On August 3, 2018, the California Department of Insurance will hold a public hearing regarding the proposed changes to the 8868 Class Codes.

The proposed changes, at the recommendation of the Workers’ Compensation Insurance Rating Bureau (WCIRB), will break the 8868 class code into the following divisions:

8868 & 9101 – K-College Schools (Academic Professionals & Non-Academic Professionals, Respectively)

8869 & 9102 – Vocational Schools, Academic Professionals & Non-Academic Professionals respectively)

8871 – Supplemental Education

8872 – Social Services

8873 – Training or Day Programs for Adults

8874 – Special Education Services for Children & Youth

8876 – Community Based Adult Services

These changes, if approved, could have a significant impact on California businesses. A recent article by the Workers’ Compensation Executer, a leading news source in the insurance industry, suggest up to 25% increases in some of the proposed class codes.

Rancho Mesa has specialized in the education arena for nearly 20 years and is prepared to assist clients with this transition. If you have any questions, please contact Rancho Mesa Insurance Services at (619) 937-0164.

Six Reasons a Company’s Experience Modification Could be Recalculated

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

Workers’ Compensation costs continue to be one of the most costly expenses for business owners in California. With recent reform, California has maintained steady rate decreases in the workers’ compensation marketplace. Unfortunately California still maintains some of the highest rates in the country, often times two to three times the nations average.

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

Workers’ Compensation costs continue to be one of the most costly expenses for business owners in California. With recent reform, California has maintained steady rate decreases in the workers’ compensation marketplace. Unfortunately, California still maintains some of the highest rates in the country, often times two to three times the nations average.

Controlling insurance costs is vital to staying profitable and often times, staying in business. An important way business owners can control their insurance costs is by controlling their Experience Modification or X-MOD. An X-MOD is a benchmark of an individual employer against others in its industry, based on that employer's historical claim experience. This comparison is expressed as a percentage which is applied to an employer's workers' compensation premium.

The premium impact of a credit X-MOD (less than 1) vs a debit X-MOD (more than 1) can be significant. Business owners budget around their insurance costs. When there are unforeseen changes to their insurance costs it can have a dramatic effect. While it is rare, there are situations when an X-MOD can change in the middle of a policy term. Below are six circumstances when this could happen:

- If a claim that has been used in an X-MOD calculation is subsequently reported as closed mid policy term AND closed for less than 60% of the aggregate of the highest value, then the X-MOD is eligible for recalculation.

- In cases where loss values are included or excluded through mistake other than error of judgement. Basically, this rule takes into consideration the element of human error.

- Where a claim is determined non-compensable. Meaning the injury was determined to be non-work related.

- Where the insurance company has received a subrogation recovery or a portion of the claim cost is declared fraudulent.

- Where a closed death claim has been compromised over the sole issue of applicability of the workers’ compensation laws of California. Basically, if a person passes away at work but it was determined that the person had a pre-existing condition which caused the death, not work itself.

- Where a claim has been determined to be a joint coverage claim. This occurs mainly with cumulative trauma claims where there was no specific incident that caused an injury, but an injury that developed over time (i.e., wear and tear).

If any of the circumstances above have occurred, than a revised reporting shall be filed with the Workers’ Compensation Insurance Rating Bureau (WCIRB) and it shall be used to adjust the current and two immediately preceding experience ratings.

If you would like to discuss this topic in further detail, and learn how Rancho Mesa Insurance can audit your X-MOD worksheet for potential recalculations, please contact us at (619) 937-0164.

Independent Contractor Classification Changes Expected to Impact Construction Industry

Author, David J. Garcia, AAI, CRIS, President, Rancho Mesa Insurance Services, Inc.

With the recent ruling by the California Supreme Court concerning how 1099 employees (independent contractors) are defined, the construction industry's approach to utilizing these workers has changed significantly. The Court adopted a new test to determine whether the worker should be classified as an employee or independent contractor. The previous test to determine if a worker was an employee or independent contractor was whether the employer had the right to direct the manner and means by which the worker performed the services.

Author, David J. Garcia, AAI, CRIS, President, Rancho Mesa Insurance Services, Inc.

With the recent ruling by the California Supreme Court concerning how 1099 employees (independent contractors) are defined, the construction industry's approach to utilizing these workers has changed significantly. The Court adopted a new test to determine whether the worker should be classified as an employee or independent contractor. The previous test to determine if a worker was an employee or independent contractor was whether the employer had the right to direct the manner and means by which the worker performed the services. Under the new test, a worker is considered to be an independent contractor only if all three of the following factors are present:

- The worker must be free from the control and direction of the hiring entity in connection with the performance of the work, both under the contract for the performance of the work and in fact;

- The worker must perform work that is outside the usual course of the hiring entities business;

- The worker must be customarily engaged in an independently established trade, occupation, or business of the same nature as that involved in the work performed.

These new factors have major implications for contractors, or any business for that matter, where previously they had classified a worker as an independent contractor and now have to classify them as an employee. This will impact several lines of insurance, but most critically workers' compensation, general liability and employee benefits.

Workers' Compensation

Currently, if an employee is classified as an independent contractor, they would not be subject to any workers' compensation premium nor workers' compensation benefits. If their status should change to employee, they now would be entitled to workers' compensation benefits and would have their payroll accounted for in the employer’s premium. In addition, based on the work being performed, this may change the employer’s risk profile, creating negative underwriting consequences in the workers' compensation carrier marketplace, resulting in coverage not being offered or higher premiums.

General Liability

The impact to general liability insurance is very similar to that of workers' compensation. Additional payroll or sales will need to be accounted for as the employer will become directly responsible for the work being performed without the benefit of any hold harmless agreement or other risk transfer methods. This could potentially change the risk profile of the employer’s operations, which could result in the employer needing to provide additional underwriting information.

Employee Benefits

Since 1099 contract workers are not employees and are considered self-employed, they do not show on the Quarterly Wage and Withholding Report (DE9 and DE9C) to the State of California. Because of this status, they typically cannot enroll in a group health insurance plan. Many workers who are now classified as independent contractors will be considered employees in the eyes of the state and will be eligible for group benefit offerings from their employer.

Employers may need to reevaluate their group size to ensure that they remain compliant with the Affordable Care Act (ACA). Employers with 50 or more full-time employees working a minimum of 30 hours per week, and/or full-time equivalents (FTEs) must offer health insurance that is affordable and provides minimum value to 95% of their full-time employees and their children up to age 26, or be subject to penalties.

While these changes are new and just beginning to take affect, we believe your best strategy moving forward is to consult with your trusted advisors in legal, accounting and risk management. This will have a significant impact to the construction industry throughout California and we intend to take a leadership role in helping those companies with concerns and questions. So, please reach out to our Rancho Mesa Team to help you navigate these changes. Contact Alyssa Burley at aburley@ranchomesa.com for assistance.

WCIRB Proposed Changes Affecting Schools and Disabled Services

Author, Chase Hixson, Account Executive, Rancho Mesa Insurance Services, Inc.

The Workers' Compensation Insurance Rating Bureau of California (WCIRB) recently announced plans to reclassify the 8868 (i.e., professors, teachers or academic professional employees) and 9101 (i.e., all employees other than professors, teachers, or academic professional employees) class codes under the belief that there is significant disparity between the businesses that currently fall under these two classifications. These changes are planned to go into effect January 1, 2019.

The Workers' Compensation Insurance Rating Bureau of California (WCIRB) recently announced plans to reclassify the 8868 (i.e., professors, teachers or academic professional employees) and 9101 (i.e., all employees other than professors, teachers, or academic professional employees) class codes under the belief that there is significant disparity between the businesses that currently fall under these two classifications. These changes are planned to go into effect January 1, 2019.

Currently the 8868 and 9101 classes, titled “schools,” consist of not only kindergarten through college schools, but also vocational schools, special education for disabled children, social services for children, and training programs for the developmentally disabled. While these businesses are similar in many ways, the claims appear to differ uniformly between these specific niches. This has a direct impact on the Experience Modifications (i.e., x-mod) of the organizations. According to the WCIRB, the average x-mod for K-12 schools and colleges is .81, vocational schools are 1.08, programs offering special education services for children are at 1.40 and training programs for developmentally disabled are at 1.30.

Average X-Mod within 8868 and 9101 Class Codes

The proposed changes will continue to include the 8868 and 9101 class codes while adding four new classifications. The theory is that this will create more homogeneous classes for the members while at the same time leveling out the X-mods for all. As the process unfolds, it could create higher insurance costs and you will want to fully understand how these changes could affect your bottom line.

While there are still more details to be worked out, it’s apparent that there are significant changes heading towards those operating with the 8868 and 9101 class codes. Whether or not an employer will be positively or negatively affected will depend on their individual risk profile.

Rancho Mesa’s Human Services Group will be taking a leadership position in understanding these changes and their impacts. To learn more about how these changes will affect your organization, please Rancho Mesa at (619) 937-0164.

CIGA is “Back in Black” - Employers will receive 2% savings on 2019 workers' comp premium

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

For the first time in 20 years, the California Insurance Guarantee Association (CIGA) will not collect its annual assessment. As a result, California employers in the guaranteed cost workers' compensation insurance market will save 2% on their premium in 2019.

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

For the first time in 20 years, the California Insurance Guarantee Association (CIGA) will not collect its annual assessment. As a result, California employers in the guaranteed cost workers' compensation insurance market will save 2% on their premium in 2019.

The CIGA board of directors approved a zero assessment for 2019, as it moved into the black after collecting last year’s 2% assessment on workers' compensation premiums. At one point, CIGA had a workers, compensation deficit of $4 Billion. The 20 years of employer assessments, ranging from 1% to 2.6% of premium, paid off workers' compensation debt and in some years the debt payments on special bonds issued to pay claims from insurance company insolvencies.

Similar to the rest of the Industry, CIGA’s improved fortune results from positive reforms provided in SB 863, as well as the efforts of Department of Industrial Relations Director Christine Baker.