Industry News

Risk Management and the Virtual Workforce

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

As American employers navigate the Coronavirus Pandemic, many business leaders quickly adapted to a virtual office and virtual workforce. While many organizations anxiously wait for the day employees can all safely head into the office Monday through Friday, employers must adjust risk management practices to account for the virtual workforce.

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

As American employers navigate the Coronavirus Pandemic, many business leaders quickly adapted to a virtual office and virtual workforce. While many organizations anxiously wait for the day employees can all safely head into the office Monday through Friday, employers must adjust risk management practices to account for the virtual workforce.

Cyber Crime

Prior to the pandemic, the FBI would routinely receive 1,000 cybersecurity complaints, daily. Since the COVID-19 outbreak began, the number of complaints has increased to 3,000 to 4,000 every day according to Tonya Ugoretz, deputy assistant director of cyber division of the FBI in a webinar hosted earlier this year. The most commonly targeted industries are health care, manufacturing, financial services, and public sector organizations. Stated plainly, cyber criminals are successfully exploiting weak virtual cybersecurity and poor execution on the part of remote employees.

Brett Landry of Landry IT, recently stated that 85% of employees circumvent “acceptable use” policies when using a company owned device, reinforcing the need for increased employee training.

Mr. Landry highly recommends employers update security patches on all devices, adopt a higher standard for password security, utilize two-factor authentication, and train employees how to recognize phishing and social engineering efforts.

How will a cyber liability insurance policy respond to this new threat?

Important questions to ask:

Will my policy cover a remote exposure?

Will my policy cover incidents involving personal devices?

Is Social Engineering covered?

Will my policy respond if an employee does not follow company procedures?

Workers’ Compensation

Allowing employees to work from home has resulted in some employees moving out of state. When this occurs, the employer should report the new working address to the insurance company to ensure the workers’ compensation insurance policy will cover an injury. In some cases, the insurance company can add the new location. If not, then the employer may need to purchase a separate workers’ compensation policy for that employee’s new state.

In an effort to manage the risk of employee injury, employers should design and implement work-from-home policies. Effective policies will clearly define work hours, communicate standards for a home office, train employees on ergonomics, reinforce work and safety rules, and remind employees of the claim reporting process. Establishing the above expectations may help employees avoid injury and legal disputes over compensability.

Directors & Officers Liability

Remember that a Directors & Officers Liability policy protects individuals from personal losses if sued for their role as a director or an officer of a company and not indemnified by the company. While a move to a virtual workforce doesn’t inherently put a board member at risk, big changes to company policy can result in missteps if employees do not receive proper communication and training. Ultimately, directors and officers are held accountable if company policies are not followed, highlighting the need for diligent execution of important company changes.

Rancho Mesa supports clients in developing employee manuals, work-from-home policies, and 2021 changes to labor law. Please contact me at (619) 937-0175 to discuss how Rancho Mesa can support your business or mission.

New Hires Pose Hidden Exposure

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

Hiring is never an easy task, especially during a pandemic. Dealing with COVID-19 has made finding the right employees much more difficult for many business owners in the construction industry. Now is the perfect time to evaluate your hiring practices to ensure you don’t make a costly hiring mistakes that can affect your Experience Modification Rate (XMOD) and workers’ compensation premium long after the pandemic has passed.

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

Hiring is never an easy task, especially during a pandemic. Dealing with COVID-19 has made finding the right employees much more difficult for many business owners in the construction industry. Now is the perfect time to evaluate your hiring practices to ensure you don’t make a costly hiring mistakes that can affect your Experience Modification Rate (XMOD) and workers’ compensation premium long after the pandemic has passed.

It was not that long ago that our economy was thriving and we had an unemployment rate under 4% in California. Though, due to the shutdown, we have seen that number shoot up as high as 16.4% in April 2020 and settle back down to 11% by September 2020, according to the Bureau of Labor Statistics (BLS). So, while many industries saw massive lay-offs, the construction industry has continued to thrive, at least for the time being. That means many employers are now actively looking for both skilled and non-skilled labor in order to complete existing projects and plan for future contracts that have been awarded. That’s great news for the 11% of the population who are unemployed, but employers should still be cautious about hiring just anyone without utilizing best practices to minimize risk.

In September 2020, Rancho Mesa partnered with Culture Works to offer the “Remote Recruiting & Company Culture Webinar” where they went into detail on the best practices for remote recruiting. Watch an archived version of the webinar to learn practical steps for recruiting employees in today’s economic climate.

Finding the right employee for the job may not be as easy as it used to be. Some skilled workers may not feel comfortable working on a job site, even while safety precautions are being observed. And, others may have been offered higher wages and more benefits at other companies who are also in need of workers. So, employers are really at a disadvantage. They may weigh the benefits and risks of hiring people who are less experienced or those who don’t take job site safety very seriously.

Now is the time to implement best practices when hiring to insulate your company from potential problems. This could mean implementing drug testing, pre-hire physicals, reach out to previous employers for recommendations, and updating your employee handbook to making sure these employees are aware of exactly what the job description is that they are being hired to do and the company’s expectations.

Experience on the job and a history of safety training are indicators that a new hire is a good risk. However, we know that employees over 45 have a 23% higher chance of having a sprain, strain or tear than employees under the age of 45. They also have a 27% higher chance of having a slip, trip or fall according to BLS. This does not mean that you shouldn’t hire workers over 45. It just means that to minimize risk, provide employees with appropriate training. Implement stretch and mobility programs for your workforce to do daily to reduce the exposure.

Rancho Mesa offers clients the Field Mobility & Stretch and ABLE Lifting training that is designed to reduce strains and cumulative trauma claims. Getting your employees prepared for the work day before they pick up their tools is vital in staying ahead of claims and boosts employee morale. The best way to handle workers’ compensation claims is to prevent them from happening.

Knowing your exposure is vital in staying ahead of industry trends. If you have further questions do not hesitate to contact me at (619) 438-6900 or ccraig@ranchomesa.com.

COVID-19 Workers Comp Surcharge Coming to California

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

Adding frustration to the growing concerns for businesses dealing with COVID-19, the Workers’ Compensation Insurance Rating Bureau (WCIRB) has recommended California employers pay a COVID-19 surcharge on their 2021 workers’ compensation policies.

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

Adding frustration to the growing concerns for businesses dealing with COVID-19, the Workers’ Compensation Insurance Rating Bureau (WCIRB) has recommended California employers pay a COVID-19 surcharge on their 2021 workers’ compensation policies.

If approved, this new COVID-19 surcharge will vary by industry and have a minimum of $0.01 and hit a maximum of $0.24 per $100.00 of payroll. The industries with less of a COVID-19 exposure can expect a lower surcharge. While industries with a higher exposure can expect a greater increase. The additional surcharge my not seem like a lot, but multiplied by a company’s payroll, it can be significant to a company’s bottom line. Additionally, this surcharge will apply to all California employers, regardless if they had any COVID-19 illnesses.

The Workers’ Compensation Insurance Rating Bureau (WCIRB) approved the surcharge after growing concerns that the number of COVID-19-related workers’ compensation claims will continue to increase. It’s been estimated this year that 11% of all workers’ compensation claims in California have been COVID-19 related. The surcharge will help the insurance carriers mitigate the growing cost of the claims that could not have been anticipated when rates were calculated for 2020 policies. Even though COVID-19 claims will not be included in California’s companies’ Experience Modification Rates (i.e., XMOD, EMR), carriers will look to a number of variables in order to adequately price for an individual company’s premium. Those will include:

Overall claims experience

COVID-19 claims experience

The COVID-19 protocols and practices that are in place

Rancho Mesa, California union employer groups, as well as several carriers including the State Compensation Insurance Fund (State Fund), oppose the surcharge idea. Our feeling, as well as many of the others, is that most carriers are now underwriting specifically for COVID-19 by evaluating the businesses’ COVID-19 claim history and safe guards. Thus, there is no need for an additional surcharge.

In the next few weeks, we will release a follow up article that will highlight the best practices employers can implement now to minimize the COVID-19 impact to their organization and 2021 workers’ compensation renewal pricing.

For questions about workers’ compensation and the COVID-19 surcharge, contact me at (619) 937-0167 or sclayton@ranchomesa.com.

Early Warning Signs of COVID’s Impact on Surety

Author, Andy Roberts, Account Executive, Surety Department, Rancho Mesa Insurance Services, Inc.

The COVID-19 pandemic will have many long and short term effects on the surety industry. While the long term effects might not be known for years, some short term changes are already occurring. Early on, we have witnessed bond companies start to tighten their underwriting guidelines, and now we are seeing an increase in General Contractors (GC) requiring performance and payment bonds from their subcontractors.

Author, Andy Roberts, Account Executive, Surety Department, Rancho Mesa Insurance Services, Inc.

The COVID-19 pandemic will have many long and short term effects on the surety industry. While the long term effects might not be known for years, some short term changes are already occurring. Early on, we have witnessed bond companies start to tighten their underwriting guidelines, and now we are seeing an increase in General Contractors (GC) requiring performance and payment bonds from their subcontractors.

For contractors that do a lot of public works, or work with GCs that require bonds already, this is not an issue, as they have already established bond programs and understand the process. However, for contractors that have never been required to bond before the pandemic, they are thrust into a part of the construction insurance world that is foreign to them. So, what exactly are performance and payment bonds and why are so many contractors now being asked to provide them?

To put it simply, the performance bond is an assurance to a project owner, or in this case a GC, by a surety company, that the contractor is capable and qualified to perform the contract and protects the GC from financial loss if the contractor fails to perform in accordance with the terms and conditions agreed upon. The payment bond assures that the contractor will pay certain subcontractors, workers, and materials suppliers associated with the project. While these assurances are meaningful, GCs very often do not require bonds because of the extra cost associated with obtaining them. Bonds typically cost 1-3% of the contract price with the GC in many cases paying the corresponding premium. COVID-19 has created turmoil in the financial marketplace many ways including a tightening of available money, a lengthening of account receivables, high unemployment, and an overall slowing of the economy. With so much uncertainty surrounding the effects that COVID-19 may have on an individual contractor’s financials, GCs are becoming more risk adverse and willing to absorb the cost of the bond to avoid subcontractor defaults in the middle of the project. In those situations the GC can then rely on the surety company that wrote the bond who will step in to make sure the work is completed.

For contractors that have never secured a bond before, the process can seem daunting, complex, and invasive, which makes having a good surety agent and bond company vital to help make the process seamless. At Rancho Mesa, we work with a number of high quality surety markets that provide a variety of different types of bond programs, and we have the expertise to get you set up with one that works best for your company’s surety bond needs.

For more information or for any questions regarding your surety needs, please contact me at (619) 937-0166 or aroberts@ranchomesa.com.

AB 685 Creates New Notice and Reporting Requirements

Author, Sam Brown, Vice President of the Human Services Group, Rancho Mesa Insurance Services Inc.

On September 17th, 2020 Governor Gavin Newsom signed into law Senate Bill 1159 (SB 1159) and Assembly Bill 685 (AB 685), both COVID-19 related bills. Both pieces of legislation will impact how employers respond to incidents of COVID-19 infections. This article will help business owners understand AB 685’s heightened occupational health and safety rules. Employers also need to understand how AB 685 grants California’s Occupational Safety and Health Administration (Cal/OSHA) greater enforcement powers.

Author, Sam Brown, Vice President of the Human Services Group, Rancho Mesa Insurance Services Inc.

On September 17th, 2020 Governor Gavin Newsom signed into law Senate Bill 1159 (SB 1159) and Assembly Bill 685 (AB 685), both COVID-19 related bills.

Both pieces of legislation will impact how employers respond to incidents of COVID-19 infections. This article will help business owners and officers understand AB 685’s heightened occupational health and safety rules. Employers also need to understand how AB 685 grants California’s Occupational Safety and Health Administration (Cal/OSHA) greater enforcement powers.

Posting Requirements

AB 685 requires California employers to provide the following four notices within one business day of being informed of a potential COVID-19 exposure:

Provide a written notice to all employees, and to the employers of subcontracted employees, who were at the same worksite within the infectious period, notifying the employee that they may have been exposed to COVID-19. It must be reasonable to assume the employees will receive the notice within one day, whether that is through email, text, or written notification.

If the employee population includes represented employees, then the employer must also send notice to the exclusive representative of the affected bargaining unit.

The employer must also provide notice of any COVID-19 related benefits or leave rights under federal, state, and local laws, or in accordance with employer policy. The employer must also notify employees of their protections against retaliation and discrimination.

The employer must notify all employers, the employers of subcontracted employees, and any exclusive representative, of the employer’s plan to complete a disinfection and safety plan in accordance with federal Centers for Disease Control guidelines.

Employers are required to maintain records of these notices for at least three years. Failure to comply with the notice requirements may result in a civil penalty.

If an employer learns of an “outbreak” as defined by the California Department of Public Health (“CDPH”), the employer must also notify the appropriate public health agency within 48 hours with the names, occupation, and worksite of any “qualifying individuals” related to the “outbreak.”

Two exceptions to the notice and reporting requirements:

Health facilities as defined in Section 1250 of the Health and Safety Code, are not required to report an “outbreak” within 48 hours.

The notice requirements do not apply to exposures by employees whose regular duties include COVID-19 testing and screening, or care to individuals who have or who are suspected to have COVID-19, unless the “qualifying individual” is also an employee at the same worksite.

Authorized Shutdown

Under AB 685, if Cal/OSHA determines that a workplace or operation within a workplace exposes employees to a risk of COVID-19 infection, creating an imminent hazard to employees, Cal/OSHA is authorized to prohibit entry to the workplace or the performance of operation in question.

If your organization would benefit from guidance on these new employer requirements, please contact Rancho Mesa Insurance at (619) 937-0175.

Sources:

https://leginfo.legislature.ca.gov/faces/billTextClient.xhtml?bill_id=201920200AB685

SB 1159 Is Now Workers’ Compensation Law

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

As expected, California Governor Newsom signed Senate Bill 1159 (SB 1159) into law Thursday, September 17, 2020 and it will have several impacts on workers’ compensation and the presumption of the claim. Below is an outline of some of the more important elements of SB 1159. In simple terms, just remember three numbers, 4/4/14 - I’ll explain, later.

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

As expected, California Governor Newsom signed Senate Bill 1159 (SB 1159) into law Thursday, September 17, 2020 and it will have several impacts on workers’ compensation and the presumption of the claim. Below is an outline of some of the more important elements of SB 1159. In simple terms, just remember three numbers, 4/4/14 - I’ll explain, later. Additionally, these rules will continue, unless modified, until January 2023. So, SB 1159 may be around for a while.

If an “outbreak” occurs, for the presumption of the claim to rest with the employer (meaning it will be presumed the person testing positive for COVID-19 contracted it at work and is therefore eligible for workers’ compensation benefits), there are several factors that need to be meet for that to occur.

If the employer has fewer than 100 employees and 4 employees test positive, or if the employer has more than 100 employees and 4% of their total employees test positive, during a 14-day period at an employer’s specific location, the COVID-19 case is presumed to be work-related. Thus, the 4/4/14 rule. When in doubt, call your workers’ compensation carrier and discuss the specific situation. They will help you determine whether or not it is a workers’ compensation claim.

Rob Darby, President of Berkshire Hathaway Homestate Companies, the second largest writer of workers’ compensation insurance in California and I discuss SB 1159 in a recent StudioOne™ Safety and Risk Management Network podcast episode “SB 1159 Impacts Workers' Comp Market.” A week before Governor Newsom signed the bill, Rob and I discussed the impacts of the bill to get an early insight. Take a listen - I think you will find it useful.

Now comes possible confusion with SB 1159. What is considered an outbreak? What is the definition of a specific location?

Outbreaks

The section of the law (Labor Code 3212.88) applies to any employee other than frontline workers and healthcare workers who test positive during an “outbreak” at the employer’s place of business, if the employer has 5 or more employees.

COVID-19 is presumed work-related if an employee worked at the employer’s place of business at the employer’s direction on or after July 6, 2020 and both the following elements are met:

The employee tested positive for COVID-19 within 14 days after working at the employer’s location.

The positive test occurred during an “outbreak” at the employer’s specific location.

An “outbreak” is defined as a COVID-19 occurrence at a specific employment location within a 14-day period AND meets one of the following:

If an employer has 100 employees or less at a specific location and 4 or more employees test positive for COVID-19;

If an employer has more than 100 employees at a specific location and 4% of the employees test positive for COVID-19;

The local public health department, State California Department of Public Health or Occupational Safety and Health Administration (Cal/OSHA) or school superintendent orders the specific place of employment to close due to risk of COVID-19 infection.

A specific location or place of employment is a building, store, facility or agricultural field where an employee performs work at the employer’s direction. An employee’s home is not considered a specific place of employment unless the employee provides home health care services to a client at the employee’s home. An employee may have more than one specific place of employment, if they worked in multiple locations within the 14-day period before their positive test.

There is a 45-day timeframe to determine if a positive COVID-19 case meets the above standard.

Outbreak Reporting Requirements

When an employer knows or reasonably should know that an employee has tested positive for COVID-19, they must report the incident to their workers’ compensation carrier. They should be prepared with the following information to give the carrier.

The fact that an employee has tested positive, regardless if work-related or not.

Employers should not include any personal information regarding the employee who tested positive for COVID-19 unless the employee asserts it is work-related or files a claim form.

The date the specimen was collected for the employee’s COVID-19 test.

The specific address or location of the employee’s place(s) of employment during the 14-day period preceding the date the test specimen was collected.

The highest number of employees who reported to work at the specific location(s) in the 45-day period before the last day the COVID-19 positive employee worked there.

It best practices to follow all local, state and federal guidelines for safe workplaces. However, even with the best intentions and precautions, COVID-19 may accidentally spread to employees. Again, when in doubt, report an employee COVID-19 case to your workers’ compensation carrier and allow them to determine how to proceed.

For questions about SB 1159 and how it with affect your organization’s workers’ compensation, contact your broker or reach out to Rancho Mesa at (619) 937-0164.

Strengthen Your Risk Profile During COVID-19

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

While the effects of COVID-19 on the workers’ compensation marketplace vary among the different business sectors, the Workers’ Compensation Insurance Rating Bureau (WCIRB) has approved a filing that will increase the 2021 pure premium advisory rates by 2.6%. With impending rate increases on the horizon, it’s more important now than ever to be proactive when it comes to your company’s risk management program. Carriers are already tightening up their underwriting guidelines and limiting schedule credits. In order to earn the most competitive pricing possible, a business must differentiate itself from other businesses. Below are three strategies you can use to strengthen your risk profile during COVID-19.

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

COVID-19 continues to have a stronghold on the US economy and it is likely that we will see the impact for many years to come. While the effects of COVID-19 on the workers’ compensation marketplace vary among the different business sectors, the Workers’ Compensation Insurance Rating Bureau (WCIRB) has approved a filing that will increase the 2021 pure premium advisory rates by 2.6%. Understand that this recommended rate increase comes against a backdrop of record profits in workers’ compensation prior to COVID-19. There are also three COVID-19 presumption Bills (AB 196, AB 644, and SB 1159) that could create presumptions that cases of COVID-19 are a compensable consequence of work, which will likely cause additional turmoil in the marketplace.

With impending rate increases on the horizon, it’s more important now than ever to be proactive when it comes to your company’s risk management program. Carriers are already tightening up their underwriting guidelines and limiting schedule credits. In order to earn the most competitive pricing possible, a business must differentiate itself from other businesses. Below are three strategies you can use to strengthen your risk profile during COVID-19.

Improve the Safety Program

Now is not the time to take your focus off of safety in the workplace. In fact, I would argue that there should be even more focus on safety. Some items to focus on relating to a safety program include:

Update your Injury and Illness Protection Program (IIPP) and have it reviewed by a labor attorney.

Establish a safety committee consisting of ownership, supervisors, managers, your insurance broker, and insurance company (i.e., loss control representative). This will assist with identifying workplace hazards, discussing claims or near misses that have occurred and creating safety meeting topics that can be discussed at future employee safety meetings.

Ensure that safety meetings are occurring at least every 10 working days, but preferably weekly. Using safety topics identified by the safety committee, managers can pinpoint proper trainings for employees.

Update Employee Handbook

With employment requirements, policies and procedures continually changing, it’s easy to fall behind on new regulations like adding an Emergency Paid Sick Leave Policy or Expanded Family and Medical Leave Policy, in your employee handbook. Rancho Mesa offers access to a living handbook builder through the RM365 HRAdvantage™ portal. By creating a living employee handbook through the portal, updating the document with new policies is as easy as reviewing and approving the suggested changes provided by experienced human resources professionals.

Continue Your Risk Management Education and Certifications

With many businesses slowing during COVID-19, consider filling that down time with required accreditations and continued education courses. Some examples include:

Anti-harassment Training: By the end of 2020, businesses with 5 or more employees are required to provide Anti-harassment training to all employees. Owners, supervisors, and management are required to complete the two-hour course, while all other employees must complete a one-hour course. Rancho Mesa offers free online Anti-harassment training for both supervisors/managers and employees. The courses can be accessed by computer, tablet, and a smart phone.

Continued education or achieving professional designations: It’s also a good time to consider working on continued education courses such as renewing forklift certifications, OSHA trainings, as well as any professional designations. To reinvest your efforts in continued education, now, while business is still slow due to COVID-19, could position your business to hit the ground running when the economy opens up again.

Safety Star Certification – With underwriting guidelines tightening and worker’s compensation premiums expected to increase due to COVID-19, Rancho Mesa’s RM365 Advantage Safety Star Program™ can build your risk profile and differentiate your business from others. The program is designed for supervisors, foreman, safety coordinators, upper management, administrators, and directors of human resources. To earn the Safety Star certification in Construction Safety, you must complete the required Incident Investigation and Analysis online module plus at least two other modules of your choice from the approved list. This certification is also a marketing tool your broker can use to show your commitment to safety.

Proactively improving your safety program, employee handbook, and continuing education during the pandemic will allow you to hit the ground running once COVID-19 restrictions are lifted. It can also position your business to mitigate increasing premiums with the ever tightening workers’ compensation marketplace.

If you need any assistance in implementing a sound risk management program, please reach out to me at (619) 937-0174.

Employers Enlist Assistance from HR Experts while Navigating Perils of COVID-19

Author, Chase Hixson, Account Executive, Rancho Mesa Insurance Services, Inc.

The COVID-19 pandemic has brought a slew of unknowns to employers across the country, especially as it relates to human resources questions and Employment Practices Liability (EPLI). Rancho Mesa’s RM365 HRAdvantage™ Portal has been a favorite of our clients ever since its release in 2019. The portal continues to grow in popularity as employers face new challenges as workplace standards and employee interaction changes, almost daily.

The COVID-19 pandemic has brought a slew of unknowns to employers across the country, especially as it relates to human resources questions and Employment Practices Liability (EPLI). Rancho Mesa’s RM365 HRAdvantage™ Portal has been a favorite of our clients ever since its release in 2019. The portal continues to grow in popularity as employers face new challenges as workplace standards and employee interaction changes, almost daily.

The most popular tool in the portal gives clients access to live certified Senior Professionals in Human Resources (SPHR) and Professionals in Human Resources (PHR) advisors via phone or through the portal’s messaging tool. Not only will the HR experts answer human resources questions, they will also follow-up with written documentation of the advice so you can refer back to their recommendations.

If an effort to ensure compliance and reduce the chance of an EPLI claim, Rancho Mesa clients are reaching out to our experts for advice on how to navigate human resource issues before they turn into a legal nightmare.

A recent client inquiry included a question about: “required postings and notifications regarding COVID-19 and how to deliver them to remote employees.” The HR experts provided guidance on how to address the client’s specific situation like getting state notices to employees who are working from home.

Another client asked “what to do if an employee refuses to come to work when restrictions are lifted.” The advice pointed to the federal Families First Coronavirus Response Act (FFCRA) and possible city ordinances or state law that may dictate how to handle the specific situation. In addition, other factors were highlighted that take into account the employee’s personal risk factors and the Occupational Safety and Health Administration (OSHA) rules for safe workplaces.

Additionally, our team is answering questions like “Can employers require employees to get tested for COVID?” or “What accommodations am I required to make for employees working from home?”

Getting reliable answers to important human resources questions quickly can mean the difference between a happy and healthy workforce, and a possible EPLI claim.

With so much uncertainty facing our clients, many have found comfort and confidence in knowing they have reliable human resources experts available to advise them as they navigate these uncharted waters.

If you have any further questions about EPLI coverage, please contact Rancho Mesa Insurance Services at (619) 937-0164.

Post COVID-19 XMODs Threaten a Double Whammy

Author, Kevin Howard, C.R.I.S., Account Executive, Rancho Mesa Insurance Services, Inc.

COVID-19 has created a multitude of challenges for California business owners in the first half of 2020. A concerning trend is the potential combination of lower payrolls and the California Workers’ Compensation Insurance Rating Bureau’s (WCIRB) recommendation to lower expected loss rates, creating what very likely could be significant Experience Modification Rate (XMOD) increases for numerous California businesses.

Author, Kevin Howard, C.R.I.S., Account Executive, Rancho Mesa Insurance Services, Inc.

COVID-19 has created a multitude of challenges for California business owners in the first half of 2020. A concerning trend is the potential combination of lower payrolls and the California Workers’ Compensation Insurance Rating Bureau’s (WCIRB) recommendation to lower expected loss rates, creating what very likely could be significant Experience Modification Rate (XMOD) increases for numerous California businesses.

Whammy #1 - Lower Payrolls

With the economy screeching to a halt in March of this year due to the shelter in place restrictions, payrolls and employee counts have been dramatically reduced. Since the XMOD calculation is based on a rolling three years of payroll and claims, should the year dropping out of the calculation have larger payrolls than the year entering and assuming the same claim amounts for each year, the XMOD would increase.

Whammy #2 – Lower Expected Loss Rates (ELR)

ELRs are the factors used to anticipate a class code’s claim cost per $100 for the experience rating period. Stated simply, it’s a rate per, $100 of payroll by class code that projects the claim amounts the WCIRB believes should occur for that class code. Thus, should ELRs decrease; it would have the effect, given no change in the claims, of raising the XMOD.

California businesses should pay close attention to their individual ELRs as the WCIRB annually recommends updated rates during their June regulatory filing period. The 2021 rates were recently proposed on June 25, 2020 by the WCIRB and will be waiting approval in September by Insurance Commissioner Ricardo Lara.

Below is a breakdown of the 2021 proposed ELRs by class code with notable double digit increases highlighted:

2021 Proposed ELRs

| Class Code | 2020 ELRs | 2021 Proposed ELRs | Increase/Decrease % |

|---|---|---|---|

| 3724 Solar/Millwright | 1.74 | 1.81 | 4% |

| 5187 Plumbing > $28 | 1.18 | 1.13 | -4% |

| 5183 Plumbing < $28 | 2.6 | 2.6 | 0% |

| 5542 Sheet Metal > $27 | 1.4 | 1.35 | -3% |

| 5538 Sheet Metal < $27 | 2.3 | 2.39 | -12% |

| 6258 Foundation Prep | 2.65 | 2.48 | 2% |

| 0042 Landscape Gardening | 2.59 | 2.38 | -8% |

| 0106 Tree Pruning | 3.91 | 4.11 | 5% |

| 5140 Electrical Wiring > $23 | 0.81 | 0.73 | -10% |

| 5190 Electrical Wiring < $23 | 1.89 | 1.82 | -4% |

| 5470 Glaziers > $33 | 1.63 | 1.81 | 11% |

| 5467 Glaziers < $33 | 4.3 | 3.81 | -11% |

| 5028 Masonry > $28 | 2.17 | 2.13 | -1.8% |

| 5027 Masonry < $28 | 4.73 | 4.03 | -14% |

| 5482 Painting/ Waterproofing > $28 | 1.42 | 1.57 | 10% |

| 5474 Painting/ Waterproofing < $28 | 3.68 | 4.08 | 10% |

| 5186 Automatic Sprinkler Install > $29 | 1.11 | 1.14 | 3% |

| 5185 Automatic Sprinkler Install < $29 | 2.45 | 2.2 | -10% |

| 5205 Concrete/Cement work > $28 | 1.95 | 1.71 | -12% |

| 5201 Concrete/Cement work < $28 | 3.95 | 3.45 | -12% |

| 5432 Carpentry > $35 | 2.01 | 2.05 | 2% |

| 5403 Carpentry < $35 | 5.27 | 4.91 | -7% |

| 5447 Wallboard Application > $36 | 1.34 | 1.14 | -14% |

| 5446 Wallboard Application < $36 | 2.76 | 2.67 | -3% |

| 5485 Plastering or Stucco >$32 | 2.66 | 2.55 | -4% |

| 5484 Plastering or Stucco < $32 | 4.78 | 4.41 | -8% |

| 5443 Lathing | 2.37 | 2.23 | -6% |

| 5553 Roofing > $27 | 3.9 | 3.89 | -2% |

| 5552 Roofing < $27 | 9.85 | 9.23 | -6% |

| 6220 Excavation/Grading > $34 | 1.24 | 1.08 | -12% |

| 6218 Excavation/Grading < $34 | 2.34 | 2.59 | 10% |

| 5436 Hardwood Flooring | 2.03 | 2.01 | -1% |

| 3066 Sheet Metal Prod Mfg. | 1.94 | 2.00 | 3% |

| 8018 Stores - Wholesale | 2.67 | 2.81 | 5% |

| 8804 Shelter/Social Rehab | 1.25 | 1.30 | 4% |

| 8827 Hospice and Homecare | 1.72 | 1.54 | -10% |

| 9059 Childcare | 0.99 | 1.07 | 8% |

| 8834 Physicians | 0.34 | 0.34 | 0% |

| 8868 Colleges/ Professors Private-Teachers | 0.36 | 0.37 | 3% |

| 9101 Colleges/Schools Private-Other | 2.50 | 2.13 | -14% |

Should Commissioner Lara approve the ELR changes in September, a majority of class codes will be seeing a decrease which can lead to higher XMOD’s in many cases. That possibility, combined with lower incoming payrolls, requires proactive risk mitigation, claim management and detailed planning with your broker.

If you are seeking a partner with the tools to address these needs, please reach out to Kevin Howard at Rancho Mesa Insurance Services, Inc. at (619) 438-6874.

Court Agrees Temporary COVID-19 Standards Are Not Needed

Author, Emily Marasso, Media Communications Assistant, Rancho Mesa Insurance Services, Inc.

On June 11th, 2020, the D.C. Circuit Court denied the American Federation of Labor and Congress of Industrial Organizations’ (AFL-CIO) lawsuit against the Occupational Safety and Health Administration (OSHA) for not issuing an emergency temporary worker safety standard due to COVID-19.

Author, Emily Marasso, Media Communications Assistant, Rancho Mesa Insurance Services, Inc.

On June 11th, 2020, the D.C. Circuit Court denied the American Federation of Labor and Congress of Industrial Organizations’ (AFL-CIO) lawsuit against the Occupational Safety and Health Administration (OSHA) for not issuing an emergency temporary worker safety standard due to COVID-19.

As a volunteer labor union group that works to improve the lives of the U.S. workforce, the AFL-CIO wants OSHA to issue a temporary worker safety standard addressing the risks of COVID-19 in the workplace. However, an Emergency Temporary Standard is authorized by OSHA under certain limited conditions. It must be determined that workers are in danger of exposure to toxic substances or agents that can be physically harmful. Plus, a temporary standard then serves as a proposed permanent standard.

The D.C. Circuit Court denied the lawsuit against OSHA due to the fact that government officials are learning new information about COVID-19 weekly, if not daily. An appropriate response to the union’s concern is not a fixed rule, at this time. And, a standard specific to COVID-19 would likely not need to become a permanent standard in the future.

Furthermore, the U.S. Department of Labor states, "We are pleased with the decision from the D.C. Circuit, which agreed that OSHA reasonably determined that its existing statutory and regulatory tools are protecting America's workers and that an emergency temporary standard is not necessary at this time.”

While a new standard to combat COVID-19 isn’t necessary because of existing standards, OSHA has provided many resources for employers to assist in maintaining worker safety. Their “Guidance on Preparing Workplaces for COVID-19” provides information on the virus, how it could affect a workplace, steps employers can take to reduce the risk to employees, and additional services and programs available to employers. The “Guidance on Returning to Work” offers steps for reopening, applicable OSHA Standards, and a frequently asked questions section. In addition, employers can find news updates and resources on OSHA’s COVID-19 webpage.

California Workers' Comp Carriers React to Commissioner's COVID-19 Amendment Approval

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

With California Insurance Commissioner Lara’s recent approval of a special regulatory filing introduced to alleviate the burden COVID-19 workers’ compensation (WC) claims threaten to have on California employers, we reached out to several prominent carrier executives to share their thoughts.

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

With California Insurance Commissioner Lara’s recent approval of a special regulatory filing introduced to alleviate the burden COVID-19 workers’ compensation (WC) claims threaten to have on California employers, we reached out to several prominent carrier executives to share their thoughts.

The amendments address accounting for employees whose job duties have changed to clerical work, which is typically a less expensive workers’ compensation insurance classification than the jobs they were performing prior to Governor Newsom’s March 19, 2020 Stay-at-Home Executive Order. It also excludes payroll for furloughed employees who are not working, but collecting a paycheck. It creates a way to identify COVID-19 cases within the California workers’ compensation system and excludes the cases from the Experience Modification Rate (XMOD) calculation.

When asked about the amendments scheduled to take effect July 1, 2020, Margaret Hartmann, Senior Vice President and Chief Marketing Officer at Berkshire Hathaway Homestate Companies, California’s second largest workers’ compensation insurance carrier, said “Lara’s approval of the WCIRB [Workers’ Compensation Insurance Rating Bureau] proposal was not surprising. These are not unreasonable, at least from the perspective of ratemaking and predicting future experience of employers once COVID passes.”

Bryan Anderson, Senior Vice President at The Zenith explained the WCIRB’s amendments to the California Unit Statistical Reporting Plan and XMOD calculation were “not likely to change under any normal circumstances but the Bureau made these recommendations to address the unique pandemic situation that California (and the world’s) businesses find themselves in."

Another industry leader Paul Zamora, ICW Group’s Senior Vice President for Workers’ Compensation Underwriting said, “We support Commissioner Lara’s decision to approve the recommended changes by the WCIRB. We believe the rule modifications accurately reflect changes in exposures created by COVID-19 and will provide the appropriate relief needed by California businesses.”

The changes were expected by California’s workers’ compensation insurance carriers as a mechanism to adjust employers’ insurance rates, since COVID-19 claims aren’t necessarily an indicator of a company’s safety record.

“Under normal situations,” Anderson explained, “workers’ compensation covers only those occupational illnesses that are created from the work environment. In this instance, that understanding changed with the Governor’s Executive Order requiring employers to accept compensability for Covid-19 claims unless they can prove they are not work-related.”

Hartmann added, “This is clear cost-shifting to the industry, which we expected. The combination of a broad WC presumption, possible additional legislation extending these presumptions past July 5th, excluding COVID from ratemaking and XMODs, means that the insurance industry will absorb the lion’s share of COVID costs that can be assigned to WC.”

Zamora points out “it’s imperative that business owners understand the rule changes and adopt new practices, particularly with respect to the record keeping criteria associated with two of the changes. By adopting new record keeping procedures to apply to the new rules, policyholders will have the necessary audit documentation to realize the full value of Commissioner Lara’s decision.”

This means employers should start documenting employees’ hours worked under each class code, now, and not wait until a final audit.

“Hopefully, these measures will play a small part in helping California employers as they try to recover from the devastating impacts of this pandemic,” Hartmann concluded.

“I think this solution is a testament to the strength and objectivity of the Bureau, the companies it represents and to the integrity of the Workers’ Compensation Industry in California,” said Anderson.

Gene Simpson, CompWest’s Vice President of Underwriting and Marketing, added, “To confront the challenges presented by the COVID-19 pandemic to California employers, regulatory authorities, insurance carriers and employers must work together on effective solutions.”

While the amendments should reduce workers’ compensation premium costs for California businesses in the short-term, only time will tell how lower revenues and higher costs due to COVID-19 claims will impact California’s workers’ compensation insurance premiums in the future.

For a greater understanding of these changes and how they will impact your company, please contact our team at (619) 937-0164.

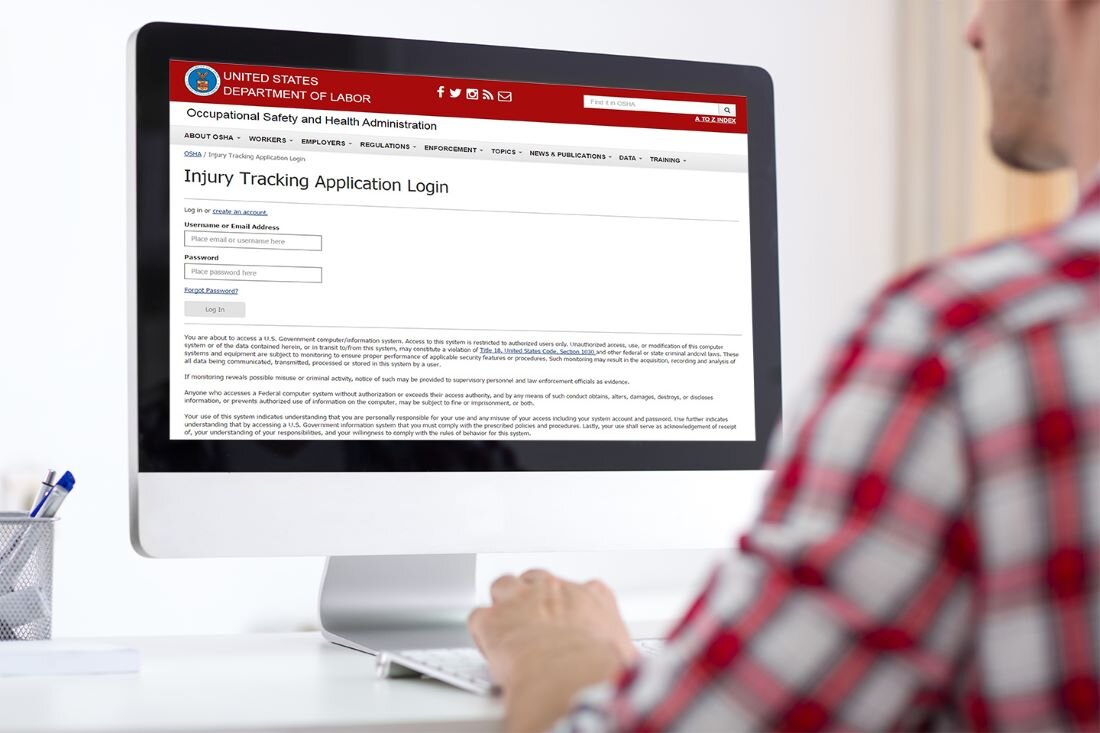

OSHA Recording Requirements for COVID-19 Cases

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

As businesses begin to reopen across the country, employers are now faced with the real possibility that one or more of their employees may be diagnosed with COVID-19. Those who are familiar with the U.S. Department of Labor’s Occupational Safety and Health Administration (OSHA) recording requirements may be wondering how to handle an employee COVID-19 case on their OSHA logs.

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

As businesses begin to reopen across the country, employers are now faced with the real possibility that one or more of their employees may be diagnosed with COVID-19. Those who are familiar with the U.S. Department of Labor’s Occupational Safety and Health Administration (OSHA) recording requirements may be wondering how to handle an employee COVID-19 case on their OSHA logs.

California’s Division of Occupational Safety and Health (better known as Cal/OSHA) has released information for employers on the subject and it appears they are using their existing criteria for determining the recordability of an employee COVID-19 case.

According to Cal/OSHA, “California employers that are required to record work-related fatalities, injuries and illnesses must record a work-related COVID-19 fatality or illness like any other illness.” To be recordable on the 300, 300A and 301 forms, the COVID-19 case must be work-related and result in one of the following:

Death.

Days away from work or transfer to another job.

Medical treatment beyond first aid.

Loss of consciousness.

A significant injury or illness diagnosed by a physician or other licensed health care professional.

The criteria that most employers may have a hard time determining is if the COVID-19 illness is actually work-related. Cal/OSHA addresses this in its Frequently Asked Questions webpage. First, the employer must determine if there was “an event or exposure in the work environment [that] either caused or contributed to” the COVID-19 case.

In order to determine if a case is work-related, employers should consider factors like:

The type and duration of contact the employee had at work with other people including co-workers and the general public.

With the implementation of physical distancing and other controls within the workplace, what is the likelihood of exposure?

Did the employee come in contact with anyone showing signs and symptoms of COVID-19, while working?

These considerations will help an employer determine whether or not the COVID-19 case is work-related and thus recordable. According to Cal/OSHA, it is best practices to err on the side of recordability when in doubt about how an employee was exposed to COVID-19.

If it is determined that an employee’s illness was work-related, yet, for a variety of reasons testing or the results from a test is unavailable and the employee has been determined to have COVID-19, “an employer must make a recordability determination” as to whether or not to record the case. While a positive COVID-19 test result would trigger recordability by the employer, a positive test is not always necessary to record the case in the OSHA logs.

Keep in mind, the above information is for OSHA recording of work-related COVID-19 cases only, which may be different from guidance for workers’ compensation claims.

Cal/OSHA states that “Governor Newsom’s Executive Order N-62-20 addresses eligibility for workers’ compensation benefits... The Order does not alter employers’ reporting and recording obligations under Cal/OSHA regulations.”

Rancho Mesa’s Risk Management Center offers employers the ability to track their COVID-19 cases electronically and generate the applicable OSHA 300, 300A and 301 forms along with an incident report and First Report of Jury (Form 5020).

To learn more about the Risk Management Center, contact our Clients Services Department at (619) 438-6869.

Commissioner Lara Approves WCIRB Proposed Amendments Addressing COVID-19

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

California Insurance Commissioner Lara has approved, as filed, the proposed special regulatory filing submitted by the Workers’ Compensation Insurance Rating Bureau (WCIRB) concerning proposed amendments addressing the Coronavirus Disease (COVID-19). The special regulatory filing is effective July 1, 2020 and will apply retroactively starting March 19, 2020, the day California Governor Newsom issued the Stay-at-Home Executive Order N-33-20. Those amendments are as follow…

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

California Insurance Commissioner Lara has approved, as filed, the proposed special regulatory filing submitted by the Workers’ Compensation Insurance Rating Bureau (WCIRB) concerning proposed amendments addressing the Coronavirus Disease (COVID-19). The special regulatory filing is effective July 1, 2020 and will apply retroactively starting March 19, 2020, the day California Governor Newsom issued the Stay-at-Home Executive Order N-33-20. Those amendments are as follows:

New COVID-19 Rule: Clerical Office Employees

Part 3, Section III, General Classification Procedures, was amended to add Rule 7, Coronavirus Disease 2019 (COVID-19), to permit during a statewide California COVID-19 stay-at-home order the following: The division of an employee’s payroll between Classification 8810, Clerical Office Employees, and a non-standard exception classification when the employee’s work is exclusively clerical in nature and the non-standard exception classification does not include Clerical Office Employees. This amendment will conclude 60 days after the Stay-at-Home Executive Order N-33-20 is lifted.

New COVID-19 Rule: Basis of Payroll

Part 4, Section IV, Exposure Information, Rule 1, Classification Code, and Rule 4, Exposure Amount, were amended to report payments excluded from remuneration pursuant to new Rule 7, Coronavirus Disease 2019 (COVID-19). Payments made to an employee while the employee is performing no duties of any kind in service of the employer are to be excluded from payroll when the payments are equal to or less than the employee’s regular rate of pay. This amendment will conclude 30 days after the Stay-at-Home Executive Order N-33-20 is lifted.

New COVID-19 Rules: Claims Reporting

Part 4, Section V, Loss Information, Rule B, Loss Data Elements, Sub rule 4, Catastrophe Number, was amended to add Catastrophe Number 12 for the reporting of COVID-19 claims. Appendix III, Injury Description Codes, Section B, Nature of Injury (Positions 3-4), and Section C, Cause of Injury (Positions 5-6), were amended to add a Nature of Injury code and a Cause of Injury code for COVID-19 claims. This amendment includes claims with an accident date after December 1, 2019, reported on a Unit Statistical Report due on or after August 1, 2020, and reported with a Catastrophe Number 12.

Exclusion of COVID-19 Claims from Experience Modification

Section VI, Rating Procedure, Rule 2, Actual Losses and Actual Primary (Ap) Losses, was amended to specify that all claims directly arising from a diagnosis of Coronavirus Disease 2019 (COVID-19) shall not be reflected in the computation of an experience modification.

For a greater understanding of these changes and how they will impact your company please contact our team at (619) 937-0164.

Topics Your COVID-19 Training Should Cover

Author, Lauren Stumpf, Media Communications Coordinator, Rancho Mesa Insurance Services, Inc.

As states begin to lift COVID-19 restrictions and move into later phases of reopening plans, and companies begin to bring back their employees, it is important to take the necessary health and safety precautions in the workplace. Your staff should be well informed about safety precautions and resources to keep one another safe. When choosing a COVID-19 employee training, make sure it is comprehensive and includes all the necessary topics recommended by local, state and federal agencies.

Author, Lauren Stumpf, Media Communications Coordinator, Rancho Mesa Insurance Services, Inc.

As states begin to lift COVID-19 restrictions and move into later phases of reopening plans, and companies begin to bring back their employees, it is important to take the necessary health and safety precautions in the workplace. Your staff should be well informed about safety precautions and resources to keep one another safe. When choosing a COVID-19 employee training, make sure it is comprehensive and includes all the necessary topics recommended by local, state and federal agencies.

The Risk Management Center offers a 10-15 minute training designed to ensure compliance with COVID-19 safety guidelines. This general awareness course on COVID-19 covers tips on how to reduce the risk of contracting the virus by using best practices. In addition, the course covers COVID-19 characteristics and related health and safety concerns.

The COVID-19 General Awareness Online Training topics include:

COVID-19 Characteristics

CDC-Recommended Basic Precautions

Tips for Limiting Exposure

Proper Hand Washing

Social Distancing

Personal Protective Equipment (PPE)

Cross Contamination

Employer Responsibilities

Employee Temperature Checks

Face Masks

Importance of proper disinfecting and sanitation

Recommended Chemicals

What to Clean and Disinfect

Working-from-Home Ergonomics

Federal Assistance for COVID-19 Related Leave

Families First Coronavirus Response Act (FFCRA)

Paid Sick Leave

Family and Medical Leave Act (FMLA)

This online training is offered for free to Rancho Mesa clients. Contact the Client Services department at (619) 438-6869 to learn more about the COVID-19 General Awareness training.

For up-to-date COVID-19 information and HR resources please visit Rancho Mesa’s COVID-19 Information Page.

Critical Elements of a COVID-19 Safety Plan

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

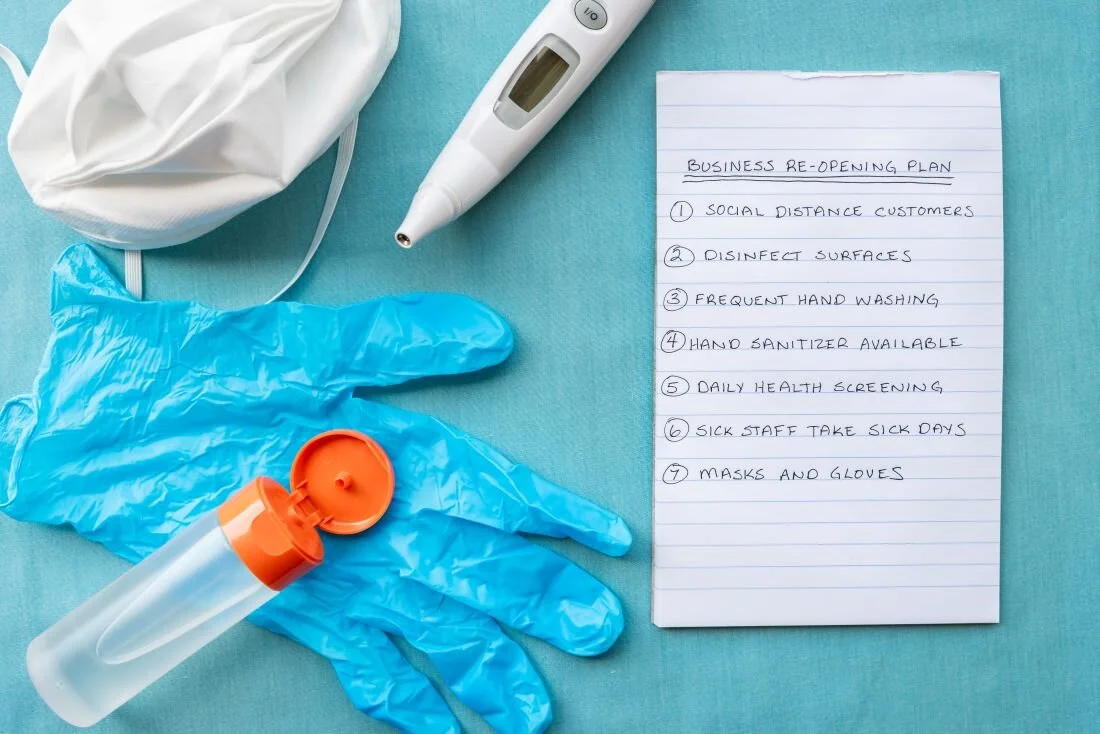

As businesses re-open across the country, it is important that we all do our part in preventing and slowing the spread of COVID-19. For many companies in construction and those in the service industry, employees often work in close proximity with others. Keeping your workforce and the public safe should be priority number one.

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

As businesses re-open across the country, it is important that we all do our part in preventing and slowing the spread of COVID-19. For many companies in construction and those in the service industry, employees often work in close proximity with others. Keeping your workforce and the public safe should be priority number one.

The Centers for Disease Control and Prevention (CDC) recommends having a written COVID-19 Safety Plan in place. Check with your local city or county for specific Safety Plan (aka Safe Reopening Plan) requirements. A well implemented plan will assist in keeping its employees and the public safe. A Safety Plan should have three critical elements; purpose, responsibilities, and safety procedures. Below is a brief explanation of these three critical elements:

Purpose: A safety plan should provide the purpose for why it is in place.

What is Covid-19? Explain the effects of the virus and how it can spread to others.

Control Measures: Train personnel on ways of minimizing exposure of Covid-19.

Personal Protective Equipment: Maintaining recommended supplies, such as respirators, eye protection, gloves, and hand sanitizer.

Compliance: Making sure your business is in compliance with local, State, and Federal emergency response and health agencies.

Responsibilities: A Safety Plan should also provide specific responsibilities for management and staff, such as:

Training and informing all on safety procedures relating to COVID-19.

Implementing a plan across all personnel.

Monitoring the application of the plan.

Safety Procedures: A Safety Plan should have mandatory procedures in place that all personnel are trained on and are strictly adhered. A few examples include:

Practicing good hygiene.

Stop handshaking, use noncontact methods of greeting.

Guidelines on how to properly disinfect surfaces like doorknobs, tables, desks, and handrails.

Creating a COVID-19 Safety Plan which explains its purpose, the responsibilities of all personnel, and safety procedures will go a long way in minimizing COVID-19 exposure. It will also have a positive effect on employee and public moral as it shows you are doing your part to stop the spread of the virus.

As your business designs a formal COVID-19 Safety Plan, Rancho Mesa can assist you with a plethora of related safety resources available in both English and Spanish. Visit www.ranchomes.com/covid-19 for a list of available resources.

Resources:

COVID-19 Safety Plan/Return-to-Work Plan Resources

San Diego County Safe Reopening Plan Template

Imperial County Sample Agency COVID-19 Response Plan (4.27.20)

Riverside County Safe Reopening Guidelines 05212020

COVID-19’s Impact on the Non-Profit Insurance Marketplace

Author, Chase Hixson, Account Executive, Rancho Mesa Insurance Services, Inc.

Businesses of all sizes across the country have been impacted by COVID-19 in some way or another. As we begin to phase back into the “new normal,” the insurance industry is seeing several changes within the non-profit sector that will significantly impact pricing and coverage, moving forward.

Businesses of all sizes across the country have been impacted by COVID-19 in some way or another. As we begin to phase back into the “new normal,” the insurance industry is seeing several changes within the non-profit sector that will significantly impact pricing and coverage, moving forward.

Rate Increases

With many businesses completely shut down and sales way off projections, insurance companies are experiencing lower annual premiums while still needing to pay out for claims. Certain lines of coverage, in particular Employment Practices Liability and Workers’ Compensation are starting to see a significant uptick in claim frequency, which will likely cause rate increases to manage these unexpected costs.

Carriers not writing any new business

Some carriers have placed a moratorium on quoting any new accounts until they can fully assess the damage on longer term exposure of COVID-19. This translates to less options for non-profit risks at renewal.

Carriers Limiting or Excluding Coverage

Many carriers are starting to increase deductible levels, lower available Umbrella limits, and eliminate certain coverage territories for certain property as a way to limit their exposure to claims. Working closely with your broker to plan for these potential gaps at your pre-renewal meeting is critical for you and your management team.

Audited Policies

In many industries, General Liability policies are audited, annually. In the non-profit space, final audits are rarely performed. In order to better account for the loss of revenues due to the shelter-in-place restrictions, many carriers will be conducting end of year audits. This could severely impact those organizations that have not been properly accounting for their exposure, as they will most likely have their revenues, employee counts, and client counts verified at the end of the policy term. Again, developing a plan now with your broker is an important part of your renewal cycle and can help maximize what potentially could be return premiums at final audit.

Looking ahead, non-profits will need to make sure they are partnered with a broker who is proactive and knowledgeable about the marketplace, so that they can stay ahead of these changes and avoid financial hardship as much as possible.

Rancho Mesa offers tools like the Risk Management Center, RM365 HRAdvantage™ portal, RM365 Advantage Safety Star Program™, weekly newsletters and Safety & Risk Management Podcast to assist our clients with successfully managing their risk and improving their marketability to carriers.

Contact Rancho Mesa Insurance Services at (619) 937-0164. to discuss your non-profit’s insurance needs.

COVID-19 Business Shutdown: What Coverage Gaps Exist with Vacant Properties

Author, Daniel Frazee, Executive Vice President, Rancho Mesa Insurance Services, Inc.

In response to the COVID-19 pandemic and ensuing shelter in place restrictions, many non-essential businesses have been shuttered for several weeks. As those businesses deal with the massive revenue and employee losses, building owners must be cautioned to review their property policies closely for vacancy provisions and exclusions.

Author, Daniel Frazee, Executive Vice President, Rancho Mesa Insurance Services, Inc.

In response to the COVID-19 pandemic and ensuing shelter in place restrictions, many non-essential businesses have been shuttered for several weeks. As those businesses deal with the massive revenue and employee losses, building owners must be cautioned to review their property policies closely for vacancy provisions and exclusions.

Vacancy clauses can create exceptions from coverage if the property in question is vacated or unoccupied for a defined period of time (most often 60 days but often shorter). For example, there are some policies that will not provide coverage if a property sits vacant more than that fixed number of days but applies to only certain types of losses like vandalism, theft, or water damage. Additional limitations can include a reduction of losses by 15% or more for more typical covered causes of loss like a building fire and certain losses can be excluded altogether once a property is vacated depending on the insurance company’s form. Finally, there are still other policies that will, in fact, provide coverage for any types of losses but stipulate that the policyholder must inform them that the property has been vacated.

What qualifies as vacant or unoccupied? Some policies define these very specifically while others are broad and ambiguous, offering little comfort at the time of loss. Rather than wait until after a loss when coverage might still be in jeopardy, take the initiative now to contact your broker if your property is vacant or partially occupied as a result of the COVID-19 pandemic. Communicating with the insurance company will help clarify definitions and interpretations and allow you to plan appropriately for the potential of a property loss.

While this continues to be an unprecedented time, several insurance companies are now sending notices to policyholders that they will not consider a building to be vacant for the days during any period of occupancy that changed as a result of the government stay-at-home order or similar directive to COVID-19. Take time now to review your policies with your broker, learn more about your specific vacancy provision and whether your insurance carrier will waive some or all of this provision during this window of time.

Subscribe to our weekly newsletter and podcast to stay informed about what’s happening in the insurance industry during this pandemic.

CA Governor Issues Executive Order Making Workers’ Compensation Benefits More Readily Available to Essential Workers

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

On Wednesday, May 6 2020, California Governor Gavin Newsom issued an Executive Order making workers’ compensation benefits more readily available to essential workers.

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

On Wednesday, May 6 2020, California Governor Gavin Newsom issued an Executive Order making workers’ compensation benefits more readily available to essential workers.

The Executive Order states “any COVID-19-related illness of an employee shall be presumed to arise out of and in the course of employment for purposes of awarding workers’ compensation benefits if all of the following requirements are satisfied:

a. The employee tested positive for or was diagnosed with COVID-19 within 14 days after a day that the employee performed labor or services at the employee’s place of employment at the employer’s direction;

b. The day referenced in subparagraph (a) on which the employee performed labor or services at the employee’s place of employment at the employer’s direction was on or after March 19, 2020;

c. The employee’s place of employment referenced in subparagraphs (a) and (b) was not the employee’s home or residence; and;

d. Where subparagraph (a) is satisfied through a diagnosis of COVID-19, the diagnosis was done by a physician who holds a physician and surgeon license issued by the California Medical Board and that diagnosis is confirmed by further testing within 30 days of the date of the diagnosis.”

Insurance companies have 30 days from the date of a COVID-19 diagnosis to rebut with evidence.

According to the Executive Order, the presumption pertains only “to dates of injury occurring through 60 days following the date of this Order.”

The order establishes a rebuttable presumption that any essential workers infected with COVID-19 contracted the virus on the job. It is important to understand the order shifts the burden of proof from the injured worker and now requires employers or insurance companies to prove the employee didn’t get sick at the place of work.

Prior to the change, it was difficult to prove workers’ compensation claims related to a COVID-19 infection.

Rancho Mesa’s Response

In response to the Executive Order and other proposed rule changes, Rancho Mesa President David Garcia interviewed Berkshire Hathaway Homestate Companies President Rob Darby on the impact to California businesses and the workers’ compensation market. Berkshire Hathaway is one of the largest workers’ compensation insurance companies in California.

Read Governor Newsom’s Executive Order on Cal/Gov website.

Please contact your Rancho Mesa broker with questions specific to your business.

Update Your Handbook with Ease Using the RM365 HRAdvantage™ Handbook Builder

Author, Emily Marasso, Media Communications Assistant, Rancho Mesa Insurance Services, Inc.

The RM365 HRAdvantage™ portal offers an easy-to-follow process to build a company handbook from scratch. Choose from a single state or multi-state based handbook with the ability to include your own custom policies. The RM365 HRAdvantage™ portal helps keep your handbook up to date and compliant by sending alerts when policies change or need to be included.

Author, Emily Marasso, Media Communications Assistant, Rancho Mesa Insurance Services, Inc.

The RM365 HRAdvantage™ portal offers an easy-to-follow process to build a company handbook from scratch. Choose from a single state or multi-state based handbook with the ability to include your own custom policies. The RM365 HRAdvantage™ portal helps keep your handbook up to date and compliant by sending alerts when policies change or need to be included.

Once your handbook is complete, you can easily rearrange your table of contents and distinguish between required, best practices and custom policies within your handbook. Policies in your handbook are chosen based on your state and employee count. Have a question about a policy or requirement and can’t find it in the portal? Reach out to one of our HR experts through the portal via messaging or phone.

Almost every day, the powers are announcing new guidelines and procedures for COVID-19 safety. With the help of the RM365 HRAdvantage™ portal, you can access a number of forms, fact sheets and posters for COVID-19 health and safety. We’ve made it easy to access these resources by linking them to the homepage. Find materials such as, sample work from home policies, sample telecommuting agreements and furlough letters. Simply click on ‘Comply’ in the menu bar and the COVID-19 link under ’Popular Tools’.

With so many of us working from home or under strict guidelines, now is the perfect time to review, modify or build your company handbook. Ready to get started building your handbook? Register for the “RM365 HRAdvantage Handbook Builder Tutorial” webinar today!

Surety Tightens Due to COVID-19 Pandemic

Author, Andy Roberts, Account Executive, Surety Department, Rancho Mesa Insurance Services, Inc.

Before COVID-19, the construction industry had been enjoying one of the longest economic booms that this county has seen in recent memory. And, even though construction has been deemed essential, the industry is already seeing some effects from the pandemic, ranging from delayed material supplies, projects being shut down, and late or non-payments from project owners.

Author, Andy Roberts, Account Executive, Surety Department, Rancho Mesa Insurance Services, Inc.

Before COVID-19, the construction industry had been enjoying one of the longest economic booms that this county has seen in recent memory. And, even though construction has been deemed essential, the industry is already seeing some effects from the pandemic, ranging from delayed material supplies, projects being shut down, and late or non-payments from project owners. Additionally, we are now starting to see some of the effects of the pandemic reach into the surety world, as some bond companies are beginning to limit their appetite and tighten their underwriting guidelines.

While some bonding companies have continued business as usual, others have made changes to their policies, with some opting to remove accounts that do not have frequent bond needs and others opting to not accept any new business submissions. While most surety carriers will not react this drastically, we anticipate them tightening their underwriting guidelines, and it is important for contractors to know that there are other options out there that might be a better fit for their bond program. This is where partnering with a Best Practices surety broker is of great benefit to a contractor.

At Rancho Mesa, we have access a variety of high quality surety markets, while also possessing a deep understanding of what different bond companies value when they are underwriting bond requests. As the markets begin to tighten, this type of knowledge becomes even more important. Certain markets will be a fit for some contractors while others will not, and selecting the wrong market can lead to financially sound contractors not receiving the level of surety credit that they need or deserve.

For more information, or for any questions regarding your surety needs, please contact Andy Roberts at (619) 937-0166 or aroberts@ranchomesa.com.