Performance-Based Workers’ Compensation Programs – Are Retros In Your Future?

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

In the past, we explored performance based workers’ compensation programs. These plans can create a competitive advantage and an opportunity to monetize your company’s insurance program.

While we have previously discussed several of these programs in detail (i.e., captives and deductibles), another option that is often overlooked; Retrospective Rating Plan (retros), could possibly be the right next step for many businesses to explore.

Typically, these plans begin to make sense once a company’s annualized premiums exceed $500,000. They contain many elements and variables that must be analyzed and understood before inception, including:

maximum, basic, and minimum premiums

required letters of credit (LOC)

loss cost factor (LCF)

losses based on incurred or paid

potential return of premium

number and frequency of recalculation of the premium/losses

recapture of premium in future calculation if claims develop

claim buyouts

Are you a candidate for a performance based program?

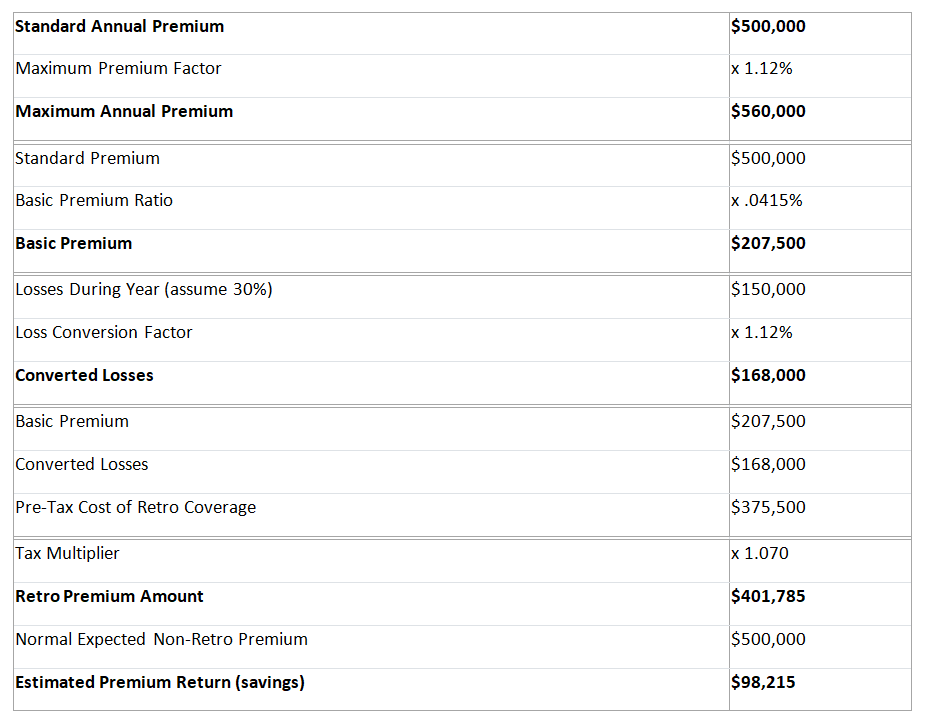

Example of a Retro Workers’ Compensation Program

Assumes a $500,000 premium with a 30% incurred loss ratio

If you would like us to create a performance model for you and your team members to evaluate, contact Rancho Mesa at (619) 937-0164 or via our website. Or, complete our performance based insurance spreadsheet and submit to Alyssa Burley at aburley@ranchomesa.com