California’s Workers’ Compensation Landscape May Reach a Valley in Coming Year

Author, Drew Garcia, Vice President of the Landscape Group, Rancho Mesa Insurance Services, Inc.

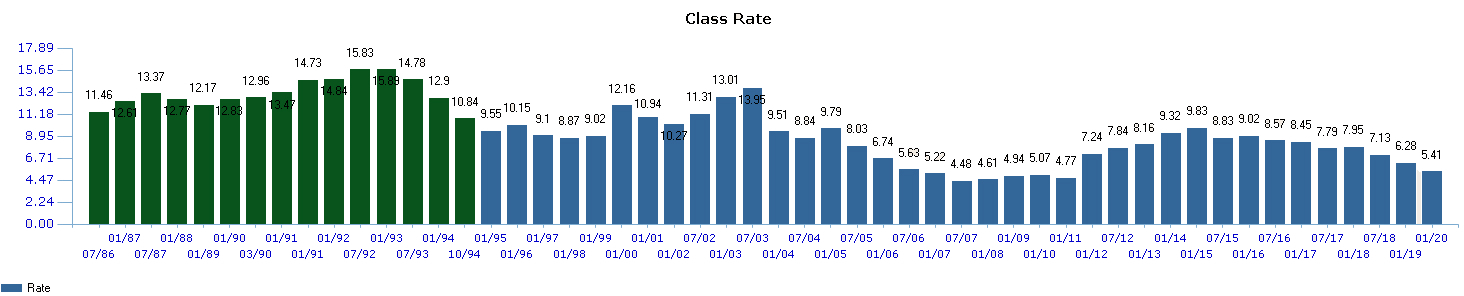

The workers’ compensation market for landscape companies in California has remained in a downward trend since 2015. As a result, landscape business owners have realized lower rates and subsequently aggressive premiums.

The following are some key insights to help landscape businesses prepare for their 2021 workers’ compensation insurance renewal.

For Experience MOD (XMOD) purposes, it’s important to know the Expected Loss Rate (ELR) for the landscape class code (0042) has decreased 8% over last year, $2.38 per $100. With a lower ELR comes an adverse effect for landscape companies’ individual XMOD, as a result of lower expected losses. Lower ELRs also drive down the primary threshold, amplifying each claim’s impact on the XMOD. Have your 2021 XMOD projected early to identify any possible implications.

Pure premium rates are developed by the Workers' Compensation Insurance Rating Bureau of California (WCIRB) and approved by the insurance commissioner to reflect the expected losses and loss adjustment expenses for each class code. Insurance carriers can then use these rates to come up with their own base rates to establish premiums. Pure premium for the landscape industry is down 8% over last year, from $5.61 to $5.14. The WCIRB also added a $.06 surcharge for COVID-19 claim impacts for the landscape industry. The Landscape Industry was labeled under tier 3 of 5, were the $.06 surcharge will be applied. Other tiers such as 4, 5, and 6 saw $.012, $.18, and $.20 surcharges as it was deemed those industries have a larger exposure share to COVID claims. In the end, with the surcharge, Pure Premium is slightly down and theoretically should lower carrier base rates.

Watch a 10-minute webinar where Drew Garcia explains the California Workers' Compensation marketplace for the landscape industry.

Areas like Los Angeles Country, Riverside County, and San Bernardino Country have had higher claims activity and claim outcomes than other parts of the state. Carriers use territory factors to more accurately align their premium for your business, depending on your location. Territory factors can either credit or debit your policy based on the location of your business or surrounding areas where you operate. For example, if you are a landscape company in Riverside County but doing business in San Diego Country, make sure you are breaking out these operations so your underwriter can accurately evaluate the correct percentage of operations in Riverside vs. San Diego.

The average base rate filed by insurance carriers for class code 0042 is $10.63, which is down 7% over last year. Carriers determine base rates based on industry appetite, historical loss experience, pure premium rates, and overhead. Not all carriers have an appetite for landscape business and the lowest base rate does not mean the lowest net rate. Insurance carriers have the ability to apply “schedule rating” which is a list of criteria they file for with the California Department of Insurance to allow underwriters the ability to deviate off the price.

In 2019, the top three carriers writing workers’ compensation insurance in California by premium volume was State Fund (10.56%), Berkshire Hathaway Homestate Companies (7.12%), and Insurance Company of the West (6.94%). Rounding out the top ten were Hartford, Travelers, AmTrust, Zurich, Chubb, Fairfax, and Employers.

Our advice for 2021:

Have your companies 2021 XMOD projected today, if not at least 6 months before your policy is set to renew.

Meet with your insurance professional 120 days before renewal to determine the renewal strategy.

If you are discussing different carrier options with your agent, ask the next level questions:

What other landscape companies does this carrier work with?

What is their rating?

How long have they written workers’ compensation in California?

Are claims handled in house or by a third party?

The numbers above indicate the perpetuation of a soft market, however, we are steadily seeing the delta of decrease shorten. Take this information to help your company formulate your renewal strategy and impact the discussions you have with your insurance agent in 2021.

If you have questions about your workers’ compensation renewal, contact me at (619) 937-0200 or drewgarcia@ranhcomesa.com.